News Home

Home - Index - News - Krisen 1992 - EMU - Economics - Cataclysm - Wall Street Bubbles - US Dollar - Houseprices

A recession of global dimensions?

U.S. consumers have the past six years been

the most maniacal spending machines the world has ever seen.

CNN, Geoff Colvin, senior editor-at-large, January 22 2008

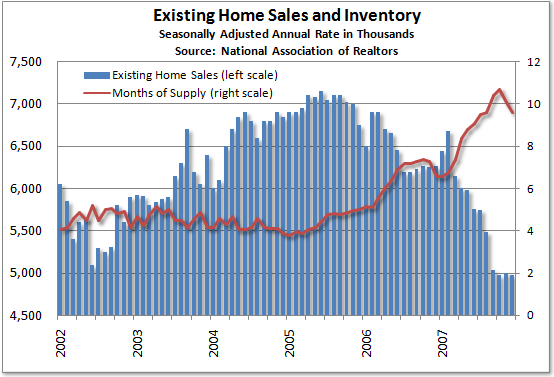

Stock market wobbles, rising interest rates, staggering personal debt, war, floods, hurricanes - nothing could slow them down. That was mainly because the value of their largest asset, housing, kept going up, and because they were confident about their jobs. As long as their home equity looked like a piggy bank and their paychecks looked solid, they just kept buying, and America's economic engine just kept turning.

That was mainly because the value of their largest asset, housing, kept going up, and because they were confident about their jobs.

As long as their home equity looked like a piggy bank and their paychecks looked solid, they just kept buying, and America's economic engine just kept turning.

Now what does any of that have to do with globalization?

That superabundance of cheap money didn't come from Americans, since we haven't been saving for years.

It came from the rest of the world, from what Fed chairman Ben Bernanke calls the "global saving glut."