The Law of Supply and Demand

- Grunden för ekonomisk tillväxt är efterfrågan.

Det är ganska självklart,

om få vill ha de varor och tjänster som produceras kommer de inte att

produceras. Olle Wästbergs nyhetsbrev, januari 2008

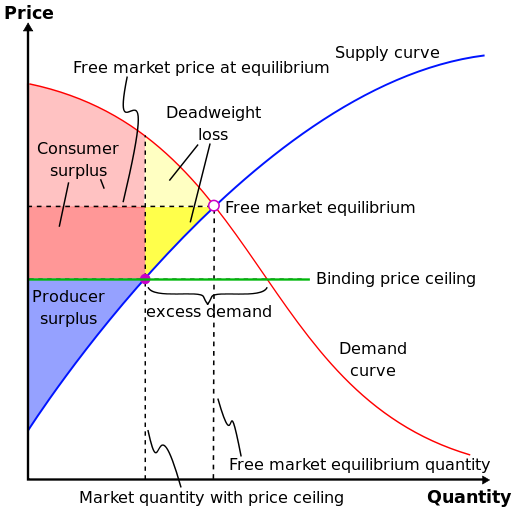

It looks very simple, but looks can be deceiving. The lines on the graph are totally hypothetical!

We can’t actually observe how much people would buy and sell at hypothetical prices.

All we can see is how much people do buy and sell in the real world.

According to the theory, that’s the point where the supply and demand curves meet.

That’s very little information.

Noah Smith Bloomberg 13 april 2018

As a result, in order to have any idea what supply and demand curves actually look like, you need to bring in lots of additional assumptions -- for example, that the price changes you observe were due only to shifts in demand or to shifts in supply

Economist Paul Romer pointed this out rather acerbically in an essay entitled “The Trouble With Macroeconomics.”

Full text

Economic theory discredited

Top of page

The Phillips curve may be broken for good

Central bankers insist that the underlying theory remains valid

The Economist 1 November 2017

Weak wage growth suggests the /US/ economy is not at full employment

Death of the Phillips curve? Nonsens.

If the economy takes off above Stall Speed the Philips Curve will be back.

Englund blog 2017-09-02

Full text

Jämviktsarbetslöshet - NAIRU

Caruana and Greenspan about stocks and shocks

Rolf Englund blog 6 Febr 2016

Solid growth is harder than blowing bubbles

The world economy has lost its last significant credit-fuelled engine of demand - China.

The result is almost certain to be a further boost to the global “savings glut” or, as Lawrence Summers calls it, “secular stagnation” — the tendency for demand to be weak relative to potential supply.

Martin Wolf, FT October 13, 2015

Simply put, we live in a world in which there is too much supply and too little demand.

The result is persistent disinflationary, if not deflationary, pressure, despite aggressive monetary easing.

Nouirel Roubini, MarketWatch Feb 2, 2015

The reason why central banks have increasingly embraced unconventional monetary policies is that the post-2008 recovery has been extremely anemic.

Such policies have been needed to counter the deflationary pressures caused by the need for painful deleveraging in the wake of large buildups of public and private debt.

Full text

Top of page

Today’s most important economic illness: chronic demand deficiency syndrome.

David Cameron “red warning lights are once again flashing on the dashboard of the global economy”.

Martin Wolf, Financial Times 18 november 2014

The lights are not as red as in 2008. Nevertheless, the difficulties caused by the fiscal austerity that his government recommends

have become particularly evident in Japan and the eurozone. These stagnant high-income economies are the weakest links in the world economy.

Jack Lew, US Treasury secretary, provided a sobering overview in a speech delivered in Seattle.

---

Remarks of Secretary Lew at the World Affairs Council of Seattle on Building a Stronger Global Economy

---

- Demand in the eurozone has yet to recover the ground lost during the crisis, remaining more than 4 per cent below its pre-crisis level.

What Mr Lew did not add is that this feeble performance – even the 6 per cent rise in real demand in the US over more than six years

is pathetic by historical standards – occurred despite the most aggressive monetary policies in history.

How do we explain such weak demand, particularly in the eurozone and Japan?

Only if we understand this do we have any hope of deciding on the right remedies.

The second set of explanations rgues that

the pre-crisis demand was unsustainable because it relied on huge accumulations of private and public debt

– the former associated with bubbles in property prices.

Full text

Secular Stagnation

Martin Wolf

The lights are again flashing red on the dashboard of the world economy, David Cameron warned yesterday.

Just to extend the metaphor, the plane is flying on empty, having pretty much exhausted its fiscal and monetary reserves,

and there is no sign of a safe landing strip in sight.

Jeremy Warner, Telegraph, 18 Nov 2014

Top of page

News

BIS

Investment by businesses is the key ingredient to cut our reliance on debt-fuelled current expenditure by consumers or the state

But there is a deeper issue to be tackled:

why does the economy have to be stimulated in artificial ways through the boosting of lending

Roger Bootle, Telegraph 6 July 2014

Grundbultsfrågan: Hur blir S = I ???

Savings and investment, being different activities carried on by different people

Man återkommer ständigt till Keynes och Hayek. Har den ekonomiska "vetenskapen" inte kommit längre?

Rolf Englund blog 8 juli 2014

ECB’s chief economist Peter Praet:

“Normally, a fall in prices would be able to support purchasing power and, therefore, domestic demand. But ..."

It seems like Praet is not entirely sure about the difference between supply and demand shocks,

but let me just illustrate the dffference in two graphs

The Market Monetarist, Lars Christensen, 15 July 2014

Full text

Aggregate Demand, Aggregate Supply, and What We Know

Paul Krugman, JULY 14, 2014

And it remains true that Keynesians have been hugely right on the effects of monetary and fiscal policy,

while equilibrium macro types have been wrong about everything.

Full text

Economic theory discredited

- Economics may be dismal, but it is not a science

Top of page

Balance sheet recession

Giving the banks more money for lending is surely not the answer to a demand problem

Call them stability bonds instead of euro bonds, if that makes the idea more palatable in Berlin.

Wolfgang Munchau, FT June 29, 2014

Low inflation has, as is to be expected, coincided with weak demand.

In the fourth quarter of last year, eurozone real demand was 5 per cent below levels in the first quarter of 2008.

In Spain, real demand fell 16 per cent. In Italy, it fell 12 per cent.

Even in Germany, real demand stagnated from the second quarter of 2011: this is no locomotive.

Martin Wolf, FT 11 March 2014

Nice chart

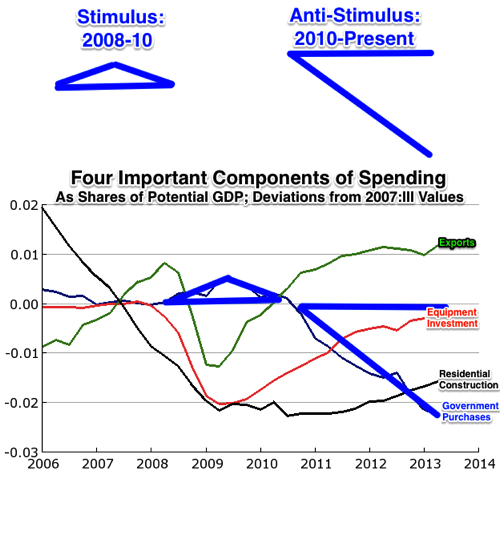

[Sarcasm]Yes, I know: "small businesses and families are tightening their belts. Their government should, too".

Brad DeLong 31 October 2013

Nouriel Roubini, Dr Doom, kommenterar Frankrike som han anser har stora problem.

Han anser att utsikterna, trots besked om åtstramningar, är mörka.

SvD Näringsliv 28 september 2012

Full text

Frankrike

Why do Keynesians Think More Spending will Stimulate the Economy?

Naked Capitalism, August 30, 2012

Spending isn’t the just the right way to grow the economy, it’s the only way.

So how do we “grow the economy”? By increasing our GDP. And how do we do that? By increasing one or some combination of the four components of GDP:

1. Consumption Spending

2. Investment Spending

3. Government Spending

4. Net Exports

Without an increase in one (or some combination) of these components of total spending, GDP cannot increase.

Now for the hard part.

MULTIPLE CHOICE: Who is in a position to lead us out of this weak recovery?

a.) Household Sector (currently deleveraging – i.e. paying down debt)

b.) Business Sector (hesitant despite low borrowing costs and mountains of cash)

c.) Government Sector

1. State/Local (still struggling with shortfalls)

2. Federal (currency issuer that can spend more when others can/will)

d.) Foreign Sector (China, India, Brazil, Eurozone, Russia, UK)

By Stephanie Kelton, Associate Professor of Economics at the University of Missouri-Kansas City.

Cross posted from New Economic Perspectives.

Full text

Tillgång och efterfrågan

Demand and Supply

Två tankar i huvudet samtidigt

Two thoughts in your head at the same time

With structural policies you hope to increase long-term pontential output.

Genom sk strukturreformer som sänkta ersättnngsnivåer i socialförsäkringarna, hoppas man

att öka den långsiktigt möjliga ökningstakten av BNP.

Med konjunkturpolitik försöker man anpassa kurvorna så att

det inte blir överhettning och ej heller blir för stor arbetslöshet.

See also: NAIRU - Se även NAIRU

The Economist explains BUSINESS CYCLE

Economics - Ekonomer

Supply and demand at Wikipedia, the free encyclopedia

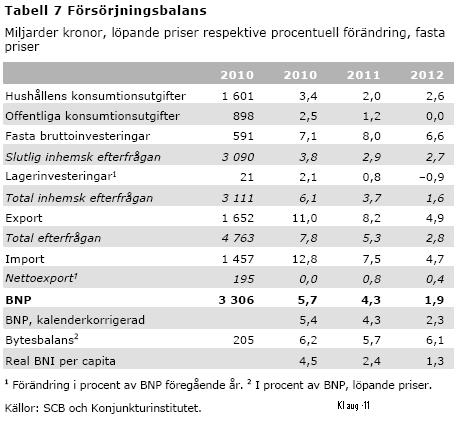

Detta är en försörjningsbalans, grunden för macroekonomisk förståelse

Danne Nordling återger den som ett led i sitt imponerande folkbildande upplysningsarbete

Det är bättre att stimulera vid en konjunkturnedgång än i högkonjunktur anser Konjunkturinstitutet i sin nya prognos.

Danne Nordling blog Skattepolitik och Samhä1lsfilosofi, 1 september 2011

Richard Koo is Chief Economist at the Nomura Research Institute

Wikipedia

Vi lever med våra etablerade sanningar

Det är antaganden som sällan eller aldrig ifrågasätts, därför att vi intalar oss att de måste vara korrekta

En sådan så kallad sanning är att Japan fullständigt misslyckats med hanteringen av sin finanskris som bröt ut kring 1990

Peter Wolodarski Signerat DN 13 januari 2013

De uppdrivna priserna kollapsade – i Japan föll värdet på kommersiella fastigheter med 87 procent – samtidigt som den privata sektorn gick från att låna pengar till att börja spara och amortera i stor skala.

En liknande typ av kris har de senaste åren inträffat i länder som USA, Storbritannien, Spanien och Irland.

Ekonomin har fastnat i det som ekonomen J M Keynes kallade för en likviditetsfälla, ett svårartat tillstånd som kanske uppstår en gång på 70 år.

I den mycket läsvärda boken ”The holy grail of macroeconomics” går den japansk-amerikanske ekonomen Richard Koo så långt som att hävda att företagen i denna situation inte längre försöker maximera sina vinster. I stället minimerar de sina lån.

Amazon

Full text hos DN

Peter Wolodarski

Japan

Stabiliseringsbpolitik

The macroeconomics of deleveraging or what Richard Koo of Nomura Research calls “balance sheet recessions”

The essential idea is that since income has to equal expenditure for the economy, as a whole,

(which is the same things as saying that saving equals investment)

so the sums of the difference between income and expenditures of each of the sectors of the economy must also be zero.

These differences can also be described as “financial balances”.

Martin Wolf, Financial Times, 19 July 2012

Full text

Today, the US private sector is saving a staggering 8 per cent of gross domestic product – at zero interest rates, when households and businesses would ordinarily be borrowing and spending money.

But the US is not alone: in Ireland and Japan, the private sector is saving 9 per cent of GDP; in Spain it is saving 7 per cent of GDP; and in the UK, 5 per cent.

Interest rates are at record lows in all these countries.

Richard Koo, Financial Times, November 4, 2012

Jag tror att man kan hitta en del nyttiga insikter bland Karl Marx läror

Dr Krugman ordinerade en rejäl återställare. Han hällde upp ett stort glas whisky som alkoholisten genast sög i sig. Det där gjorde susen, sa han och log

Patrik Engellau, SvD Brännpunkt, 19 juli 2012

Deleveraging

BNP är C + I + G +/- X Skall det vara så svårt att förstå för microhjärnorna?

Rolf Englund blog 2010-02-02

Början på sidan

Arbetslinjen, kallas det. Resonemanget känns igen från snart sagt alla moderata utspel på senare tid.

Många ska arbeta mycket och länge, lyder det moderata beskedet. Det är förstås ett angeläget budskap i ett land där allt fler arbetar allt mindre.

Men att göra den samlade volymen av arbetsutbud till den stora politiska visionen blir blodfattigt och torftigt.

SvD-ledare 29/8 2005

Kommentar av Rolf Englund

Ja, i synnerhet om man bara ökar utbudet och inte samtidigt ökar efterfrågan.

Stimulera inte fram fler jobb, varnar prof Jonung

Danne Nordling blog 21/8

Konjunkturinstitutets chef Ingemar Hansson:

Vad som behöver göras för att höja sysselsättningen är alldeles klart, menar han. Det behövs en bättre integration av utrikes födda, färre sjukskrivna och färre förtidspensionärer

DN 29/8 2005

Generaldirektör för Konjunkturinstitutet sedan 1999. I finansdepartementet 1988-99, bland annat som skatteutredare och chef för ekonomiska avdelningen. Professor i nationalekonomi vid Lunds universitet.

Född 1951, Fritidsintressen: skön- och facklitteratur, golf samt familj och vänner.

Kommentar av Rolf Englund:

Hur kan färre sjukskrivna och färre förtidspensionärer leda till ökad sysselsättning? Det leder

till ökad arbetslöshet, om inte efterfrågan och produktion ökar.

Ingemar Hansson var med Göran Persson när de "huttrade i kylan åt hamburgare på en nedsliten, dåligt uppvärmd McDonalds-restaurang"

inför Göran Perssons möte med de "flinande 25-åriga finansvalparna", varefter

Göran Persson, från Vingåker, blev så rädd för de flinande 25-åriga finansvalparna att

han åkte hem och skar ner den svenska välfärden, mitt i brinnande

lågkonjunktur.

Läs Görans Perssons berättelse här

Från Danne Nordling blog:

En som tar lätt på arbetslösheten är Konjunkturinstitutets chef Ingemar Hansson, som i dagens DN (29/8) säger att det bara är 50 000 personer som är arbetslösa av konjunkturskäl. Han varnar för finanspolitiska åtgärder som försvagar budgetsaldot

Klicka här

Top

- En ofta framförd föreställning i Europa är att det skapats fler jobb i USA därför att amerikansk

arbetsmarknad är mer avreglerad. McKinsey:s studier visade att det visserligen är korrekt att

amerikansk arbetsmarknad överlag varit mindre reglerad än europeiska. Men vad säger att bara för att

det finns utbud av arbetskraft så skapas efterfrågan?

Ur skriften "Reformer i Europa"

av Göran Normann och Peter Stein på uppdrag av Svenskt Näringslivs Kris- och framtidskommission, Augusti 2006

Carl B Hamilton, riksdagsman fp, angriper Assar Lindbecks förslag till mer expansiv finanspolitik med argumentet att den redan är mycket expansiv.

Danne Nordling blog 2005

How I Learned to Stop Neoclassicizing and Love the Liquidity Trap

There is only one real law of economics: the law of supply and demand.

If the quantity supplied goes up, the price goes down.

Brad DeLong, November 05, 2011

The contrast between the macroeconomic management of the US and that of the eurozone during the past five years could not be greater

Where does this difference come from?

The practical men in Frankfurt have become the slaves of a theory telling us that the sources of economic cycles are shocks in technology (productivity shocks) and changes in preferences.

Paul de Grauwe, Financial Times 17/8 2005

Other things equal, demand is higher, the lower the real interest rate.

Do you really want to quarrel with that?

But right now, thanks to the aftermath of the financial crisis, even a zero nominal rate, which is a slightly negative real rate, isn’t low enough to produce full employment.

if you can’t raise employment by cutting interest rates, deficit spending — which doesn’t crowd out private spending when the interest rate doesn’t change — becomes a way to put unemployed resources to work

Paul Krugman New York Times August 23, 2010

In normal times, when the zero lower bound isn’t binding, this basic framework suggests that conventional monetary policy can play the key role in stabilization. So in normal times I’m all in favor of having the Fed take on the job of managing the business cycle, and basing fiscal policy on long-term concerns.

But now we’re up against the zero lower bound; and that changes everything.

The case for fiscal expansion also comes out of this fairly straightforwardly: if you can’t raise employment by cutting interest rates, deficit spending — which doesn’t crowd out private spending when the interest rate doesn’t change — becomes a way to put unemployed resources to work.

Full text

Top of page

Leading the PIIGS to an (as yet) Unrecognized Slaughter

Everyone cannot export their way out of this crisis.

Someone has to actually run a current account deficit.

Rob Parenteau at John Mauldin 9/3 2010

The Role of House Prices in Formulating Monetary Policy

Fed Governor Frederic S. Mishkin, 17/1 2007

Alan Greenspan the 2001 Bush tax cuts

"They should follow the law and let them lapse," Greenspan said.

The government needs the revenue

July 16, 2010

Greenspan said reducing the deficit is "going to be far more difficult than anybody imagines" after "a decade of major increases in federal spending and major tax cuts."

Full text

Paul Krugman, Niall Ferguson

The vanity of economists needs to be challenged.

Above all, their claim to scientific rigour – buttressed by models and equations –

must be treated much more sceptically.

Gideon Rachman, FT September 6 2010

There has been some self-examination and soul-searching within the economics profession since the onset of the financial crisis. Joseph Stiglitz, another Nobel prize-winning economist, has suggested that: “If science is defined by its ability to forecast the future, the failure of much of the economics profession to see the crisis coming should be a cause of great concern.” Yet Prof Stiglitz’s conclusion is disappointingly mild: economists must simply search for new “paradigms” – and then presumably go back into the business of scientific prediction.

For somebody educated as a historian, there is an obvious alternative conclusion to draw from Prof Stiglitz’s opening observation. And that is to conclude that the entire attempt to treat economics as a “science ... defined by its ability to forecast the future” is misconceived.

Economists seem unlikely to abandon the belief that theirs is a discipline that makes “progress” and settles issues, in a way that resembles a hard science such as physics or chemistry. Ben Bernanke, the current head of the Federal Reserve, exemplified this belief in a famous speech in 2004 on the “Great Moderation”, in which he argued that there had been a “substantial decline in macroeconomic volatility”, largely because of improved monetary policy, based on advances in economic thinking.

Full text

Top

The discussion of fiscal stimulus this past year and a half has filled me with despair over the state of the economics profession.

Paul Krugman July 18, 2010

If you believe stimulus is a bad idea, fine; but surely the least one could have expected is that opponents would listen, even a bit, to what proponents were saying. In particular, the case for stimulus has always been highly conditional.

Fiscal stimulus is what you do only if two conditions are satisfied: high unemployment, so that the proximate risk is deflation, not inflation; and monetary policy constrained by the zero lower bound.

That doesn’t sound like a hard point to grasp.

Full text

Krugman versus Ferguson: Round Two

Not since Ken Rogoff’s famous attack on Joe Stiglitz has the dismal science of economics provoked such pompous, self-important, personalised squabbling.

The reality is that nobody knows what cutting the deficit into a weak economic recovery is going to do to output and jobs

Jeremy Warner, The Daily Telegraph, 20 July 2010

My new maxim, never to stand in the middle of a fight between Paul Krugman and Niall Ferguson

It says a lot about the talents of John Maynard Keynes – and just as much about the shortcomings of modern macroeconomics – that when the financial crisis struck, policymakers instinctively reached not for their fancy models, but for the Keynesian idea of fiscal stimulus

Tim Harford, FT July 20 2010

Highly recommended

The great austerity debate

Jon Kyl of Arizona, the second-ranking Republican in the Senate, was asked the obvious question:

if deficits are so worrisome, what about the budgetary cost of extending the Bush tax cuts for the wealthy, which the Obama administration wants to let expire but Republicans want to make permanent? What should replace $650 billion or more in lost revenue over the next decade?

His answer was breathtaking:

Paul Krugman, New York Times July 15, 2010

“You do need to offset the cost of increased spending. And that’s what Republicans object to. But you should never have to offset the cost of a deliberate decision to reduce tax rates on Americans.”

So $30 billion in aid to the unemployed is unaffordable, but 20 times that much in tax cuts for the rich doesn’t count.

Now there are many things one could call the Bush economy, an economy that, even before recession struck, was characterized by sluggish job growth and stagnant family incomes; “vibrant” isn’t one of them.

But the real news here is the confirmation that Republicans remain committed to deep voodoo, the claim that cutting taxes actually increases revenues.

Full text

If ever there have been federal tax cuts tailored to produce supply-side economic behavior, they were implemented during President George W. Bush’s administration starting in 2001.

The data suggest that any extraordinary investment that has occurred in the wake of the George W. Bush tax cuts has been in residential real estate and consumer durable goods.

Paul L. Kasriel, May 25, 2007

The idea of supply-side economics was born when a guy called Arthur Laffer sketched a curve on a cocktail napkin in 1974, and the debate over its merits has been raging ever since.

The Law of Supply and Demand

Emily Messner, Washington Post, December 18 2005

Why would the ruling party cut taxes for the wealthy instead of, say, providing childcare for the poor, or making sure the District of Columbia has enough money for every student to get his own textbooks?

The answer lies in trickle down economics.

Fans of the theory don't like to use that term because it astutely describes the phenomenon - the economic benefit flows downstream until it's just a trickle.

My skepticism should not be construed as a blanket condemnation of the Reagan tax cuts. Surely we can agree that a top tax bracket of 70 percent is outlandish and it was a good move to get that figure down significantly.

In his Friday column, a triumphant E.J. Dionne heralded the end of this era, declaring supply side economics solidly debunked. Dionne believes Republicans are finally starting to see that "the help-the-wealthy, damn-the-deficits approach doesn't hold together, either as policy or politics."

Full text

Supply-side economics

The Republican Party is fracturing before our eyes.

Moderate Republicans know these cuts in programs for the poor are unsustainable. Very conservative Republicans want to cut spending far more than the rest of the party (or its voters) will allow.

E. J. Dionne Jr. December 16, 2005

The Republican leaders may or may not pass their cut-from-the-poor, give-to-the-rich budget. It takes a degree of political incompetence usually associated with Democrats for the side that wants to preserve the true spirit of Christmas to invite so many coal-in-the-stocking metaphors at this time of year.

But there is something more important about this failure. It marks the dead end of a worn, haggard argument that conservatives have been peddling for 30 years, ever since that energetic guru of supply-side economics, Jude Wanniski, published his first articles on the subject and his exciting 1978 manifesto, "The Way the World Works."

Supply-siders asserted that cutting taxes on the wealthy -- and especially on savings and investment -- would help everyone, including the poor, by promoting economic growth.

Tax cuts would produce so much growth that they would pay for themselves.

For many of us, this whole argument was always a highfalutin rationalization for giving the rich what they wanted, and often even more. Bill Clinton's economic policies should have definitively destroyed supply-side claims: Clinton raised taxes on the wealthy and cut the deficit, and an exceptional period of economic growth followed.

But it took until this moment in 2005 for Republicans themselves to realize (even if many won't acknowledge it yet) that the help-the-wealthy, damn-the-deficits approach doesn't hold together, either as policy or politics. They are learning that the public doesn't buy the idea that cutting taxes on dividends and capital gains should take priority over providing health coverage and child care for struggling Americans.

The tax cuts, it turns out, don't pay for themselves.

As a result, the Republican Party is fracturing before our eyes.

Republican leaders tilt this way and that, juggling this tax cut with that spending cut. In the process, they alienate just about everybody. The old faith is dying.

What's clear is that if Republicans and conservatives keep trying to sell their long-playing supply-side records in the age of the iPod, they'll confine their audience to antiquarians and ideological hobbyists. It's the way the world works.

Full text

Top

Let's look at what Bernanke really said.

"Sustained deflation can be highly destructive to a modern economy and should be strongly resisted. Fortunately, for the foreseeable future, the chances of a serious deflation in the United States appear remote indeed, in large part because of our economy's underlying strengths but also because of the determination of the Federal Reserve and other U.S. policymakers to act..."

John Mauldin, 28/10 2005

Very Important Article

Ur faktaruta

Konjunkturfall kan vara av tre slag, som ibland inträffar samtidigt och förstärker varandra: normal lågkonjunktur, externa chocker som krig eller terrorangrepp och politiska misstag som det svenska kronförsvaret i början av 1990-talet.

Metro 29/8 2005

Keynes är ett passerat kapitel och så bör det förbli.

SvD-ledare 29/7 2005

Svenskt Näringsliv avstyrker det föreslagna finanspolitiska rådet. Det finns inget behov för ett sådant eftersom vi anser att aktiv stabiliseringspolitik inte skall bedrivas.

Germany’s incoming “grand coalition” of Christian Democrats and Social Democrats is about to commit the biggest economic policy error since unification – the attempt to pursue budget consolidation at the expense of all other economic policy goals. In doing so, it risks turning a five-year-long stagnation into a full-scale depression.

It would be more accurate, perhaps, to compare her /Ms Merkel/ to Heinrich Brüning, a Christian conservative who was German chancellor from 1930 to 1932.

Wolfgang Munchau, Financial Times, 7/11 2005

Wolfgang Munchau is an associate editor of the Financial Times