Home - Index - latest.htm">News - Krisen 1992 - EMU - Cataclysm - Wall Street Bubbles - Next Bubble: U.S. Government Bonds

|

For the moment, the broadly unanticipated behavior of world bond markets remains a conundrum. Bond price movements may be a short-term aberration, but it will be some time before we are able to better judge the forces underlying recent experience." Alan Greenspan, before Congress, February 16, 2005 |

|

Confusion reigns. The global economic climate is marked by a staggering boom in China,

apparent stagnation in Europe, a massive US trade deficit, booming corporate profits, soaring (until recently at least) commodity prices and government bond yields at their lowest level for a generation. It is hard to knit all these themes together. Philip Coggan, Financial Times, 21/5 2005 |

The Sorrow and the Pity of Another Liquidity Trap

I had read Hicks. I even knew Hicks. But I thought that his era, the Great Depression, had passed.

Brad DeLong, Bloomberg 5 July 2011

Although I worked for three years in the Clinton Treasury Department, and am a card-carrying member of the economist guild, I predicted none of this. Like most of my peers, I was wrong. Yet the most interesting thing is that I could have -- should have -- been right. I had read economist John Hicks; I just didn’t quite believe him.

Hicks, one of the clever young Brits dotting i’s and crossing t’s in the writings of John Maynard Keynes in the 1930s, was responsible for the workhorse formulation of Keynesian economics -- the IS-LM model -- that has been the bane of many an intermediate macroeconomics student.

But when rates become so low that there’s little difference between cash and short-term government bonds, open-market operations cease having an effect. This is the liquidity trap.

In this situation we need deficit spending.

I had read Hicks. I even knew Hicks. But I thought that his era, the Great Depression, had passed. Sitting in my first graduate economics class in 1980, I listened to Marty Feldstein and Olivier Blanchard -- two of the smartest humans I am ever likely to see -- assure me that Hicks’s liquidity trap was a very special case, into which the economy was unlikely to wedge itself again. Yet it did.

On my shelf is a slim, turn-of-the-millennium volume by Paul Krugman titled “The Return of Depression Economics.”

In it he argued that we mainstream economists had been too quick to ditch the insights of Hicks -- and of economists Walter Bagehot and Hyman Minsky.

Krugman warned that their analysis was still relevant, and that if we dismissed it we would be sorry.

I am sorry.

The most interesting moment at a recent conference held in Bretton Woods economic came when Martin Wolf quizzed Larry Summers

"[Doesn’t] what has happened in the past few years, simply suggest that [academic] economists did not understand what was going on?”

J. Bradford DeLong, 2011-04-29

Confessions of a Financial Deregulator

Depression-era restrictions /Glass-Steagall/ on risk seemed less urgent,

given the US Federal Reserve’s proven ability to build firewalls between financial distress and aggregate demand.

New ways to borrow and to spread risk seemed to have little downside.

J. Bradford DeLong, project-syndicate.org, 2011

The IS-LM framework, invented by Sir John Hicks in 1937 as an interpretation of Keynes's “General Theory”

casts useful light on why bond yields are so low.

The Economist 11/8 2005

WHEN The Economist's economics editor studied macroeconomics in the 1970s, the basic model for understanding swings in demand was the so-called IS-LM framework, invented by Sir John Hicks in 1937 as an interpretation of Keynes's “General Theory”. In recent years it has gone out of fashion, dismissed as too simplistic. That is a pity, for not only does the model seem more relevant than ever today, but it also casts useful light on why bond yields are so low.

Its main virtue is that it brings together both the real and the financial parts of the economy. The IS (investment/saving) curve represents equilibrium in product markets, showing combinations of output and interest rates at which investment equals saving and hence the demand for goods and services equals supply. The IS curve slopes downwards, because a higher interest rate reduces spending and so lowers the level of output at which demand equals supply.

The interest rate on 10-year Treasury bonds yesterday dropped to nearly 4%.

In February, he called the behavior of market interest rates a "conundrum" - a rare Greenspanian acknowledgment that he couldn't explain what is happening. Since then, the Fed has "raised rates" two more times, and the conundrum has deepened. It has become the central mystery of today's economy.

The global economic climate is marked by a staggering boom in China, apparent stagnation in Europe, a massive US trade deficit, booming corporate profits, soaring (until recently at least) commodity prices and government bond yields at their lowest level for a generation.

Philip Coggan FT 21/5 2005

George Cooper is a strategist at Deutsche Bank in London. In his latest note The Burden of Sisyphus)he argues that the US Federal Reserve may have learnt the wrong lesson from the Japanese experience of the 1990s.

Richard Duncan is an American who works for a Dutch bank in Hong Kong. His analysis, in a revised version of his book (The Dollar Crisis: Causes, Consequences, Cures, published by John Wiley) also focuses on Japan and the US.

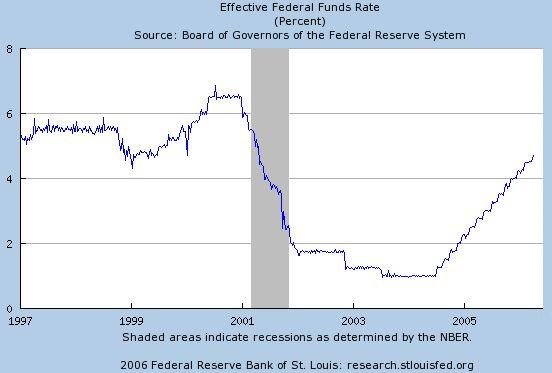

In February 2005, Fed Chairman Alan Greenspan made his famous remark about a “conundrum” in the American bond market.

He found it puzzling that long term bond yields were declining in a period during which the FOMC had just raised short-term rates by 150 basis points.

The fall in the dollar and the rise in equities during the tightening phase also seemed counter-intuitive to many investors.

Gavyn Davies, FT 12 March 2017

The Greenspan conundrum has, for now, disappeared.

Matthew Klein wrote a classic FT Alphaville blog examining the Greenspan conundrum in 2015.

It is worth re-reading in full.

Monetary policy in a low-rate world

Martin Wolf, FT 13 September 2016

Last month, the Fed lifted interest rates for the first time in nine years, and short-term bond yields have duly climbed higher.

But longer-term Treasury bonds have shrugged, with yields actually falling since the US central bank tightened monetary policy.

Robin Wigglesworth, Financial Times 7 January 2016

In financial jargon, the Treasury “yield curve” is flattening, with the difference between shorter- and longer-term bond yields narrowing sharply.

The spread between the two and 10-year Treasury yields is now below 1.2 per cent — close to the smallest gap since early 2008.

Next Bubble Is Forming: U.S. Government Bonds

US government debt is a safe haven the way Pearl Harbor was a safe haven in 1941.

Click

In all, the massive speculation unleashed in the equity markets since the March 2009 bottom

has caused more than $5 trillion of current cash flow and new debt to be allocated to corporate stock buybacks, M&A deals and LBOs.

The stock market is thus a creature of financial engineering, not a mechanism for efficiently allocating capital and accurately pricing prospective risk and return.

David Stockman, October 20, 2015

What I wish George Will, Bill Gross, and other free market advocates would consider is

the possibility that the Fed itself is not the source of the low rates, but simply is a follower of where market forces have pushed interest rates.

That is, the Great Recession and the prolonged slump that followed caused interest rates to be depressed and the Fed did its best to keep short-term interest rate near this low market-clearing level.

Economists view 20 October 2015

Conundrum Redux

The "conundrum" was that Greenspan couldn't control long term rates as he wished.

Long rates do not always track short rates or Fed pronouncements.

The Grumpy Economist, John Cochrane's blog, September 15, 2015

FT's Alphaville has an excellent post by Matthew Klein on long-term interest rates, organized around Greenspan's "conundrum."

As the post nicely shows, it was ever thus.

The Greenspan conundrum in reverse

Reserve selling means yields rise more than Fed expects

James Mackintosh, FT 2 September 2015

Central banks and bond investors spent a lot of the past decade worrying about the savings glut from China, emerging markets and the recycling of petrodollars. Now there is a new concern: it might be over.

Emerging market foreign exchange reserves soared from $1tn to $8tn between 2003 and summer last year, but since then have begun coming down again. In part this is because of the fall in dollar terms of reserves held in euros and yen, but large sums are also being spent by EM central banks to defend their currencies as fast money leaves in a hurry — with Goldman Sachs estimating China alone might have burnt through more than $100bn in the past two months.

Why China currency moves may spell end of Greenspan ‘conundrum’

MarketWatch Aug 18, 2015

Conundrum

How would the Fed react if long-term US Treasury rates fail to rise after it has started lifting policy rates?

The topic was debated by the economics commentariat at considerable length last year, as the yield curve flattened

and at one point there was a strange, unprecedented fall in correlation between 5-year and 10-year yields

Cardiff Garcia, FT Alphaville 2 April 2015

Put another way, the relevant issue is whether shifts in the yield curve away from the obvious intent of US policymakers will also have unintended effects on the economy.

The obvious channel through which an unwelcome deviation could occur is the global monetary system, in which the US is the dominant presence and therefore cannot avoid the impact of large pervasive imbalances.

Conundrum

Alan Greenspan couldn’t control long-term interest rates a decade ago,

and bond investors are betting Janet Yellen’s luck will be no better.

Bloomberg, 19 November 2014

When then-Federal Reserve Chairman Greenspan raised the benchmark overnight rate from 2004 to 2006, long-term borrowing costs failed to increase,

thwarting his attempts to tighten credit and curb excesses that contributed to the worst financial crisis in 80 years.

“We wanted to control the federal funds rate, but ran into trouble because long-term rates did not, as they always had previously, respond to the rise in short-term rates,”

Greenspan said in an interview last week. He called this a “conundrum” during congressional testimony in 2005.

Conundrum

After numerous boom-bust cycles driven by domestic safe asset shortages,

emerging markets learned to export rational bubbles to economies with a comparative advantage in generating safe assets.

Mike Story (hm), FT July 14 2010

"Mike Story is an economist at Western Asset, a subsidiary of Legg Mason"

In today’s world of free-flowing capital, rational bubbles will tend to develop in economies with deep financial markets, ie, advanced economies with strong property rights, streamlined bankruptcy procedures, flexible financial systems and low risk of government expropriation.

Not surprisingly, demand for safe assets resulted in government yields in advanced economies falling to unusually low levels where central bankers struggled to raise yields (recall Alan Greenspan’s “conundrum” where the US 10-year yield declined 70 basis points (bps) despite the Fed raising its funds rate by 200 bps).

In response to this excess demand for safety and liquidity, the banking system began exploiting its ability to engineer risk-free assets from risky assets to keep pace with the safe asset shortage. By pooling risky loans and tranching their cash flows, triple A-rated assets could be synthetically generated to make up for the shortfall.

What I hear more and more, both from bankers and from economists, is that the only way to end our financial crisis is through inflation.

Their argument is that high inflation would reduce the real level of debt, allowing indebted households and banks to deleverage faster and with less pain.

The advocates of such a strategy are not marginal and cranky academics. They include some of the most influential US economists.

Wolfgang Münchau, Financial Times, May 24 2009

Greenspan: The Fed Didn't Cause the Housing Bubble

Lower rates on long-term, fixed-rate mortgages and

not the Federal Reserve's policies are to blame for the U.S. housing bubble.

CNBC 11 Mar 2009

"Between 2002 and 2005, home mortgage rates led U.S. home price change by 11 months.

This correlation between home prices and mortgage rates was highly significant,

and a far better indicator of rising home prices than the fed-funds rate,"

Greenspan wrote in the Wall Street Journal.

Skuldfrågan/Who is responsible

Why Greenspan does not bear most of the blame

The US is in no way exceptional for the level of residential investment.

Somewhat to my surprise, the share of residential investment in UK gross domestic product has been much the same as in the US.

The outliers here are Ireland and Spain.

Martin Wolf FT April 8 2008

Ben Bernanke: "We have a problem"

'We have a problem, which is that the spreads between the Treasury rates and lending rates are widening, and our policy is essentially, in some cases just offsetting the widening of the spreads, which are associated with signs of illiquidity."

Eurointelligence/calculatedrisk blog 29/2 2008

Bernanke told the House Financial Services Committee

In other words, the Fed is experiencing what many of us had predicting all long - that cuts in short-term interest rates are not going to help in this situation.

In the US, the cost of fixed mortgages is now higher than it was during October, despite the record cuts in policy interest rates.

Full text at Eurointelligence with link to calculated risk blog

Houston, we have a problem

Originally a genuine report of a life-threatening fault. Now used humorously to report any kind of problem.

John Swigert, Jr. and James Lovell who, with Fred Haise Jr., made up the crew of the US's Apollo 13 moon flight used (almost) this phrase to report a major technical problem back to their Houston base.

www.phrases.org.uk/

Apollo Expeditions to the Moon, CHAPTER 13.1

"Houston, We've Had a Problem", By JAMES A. LOVELL

The new conundrum

When Alan Greenspan hiked short-term rates, long-term rates barely moved.

Ben Bernanke is cutting interest rates but bond yields are rising. Here's what it means.

Chris Isidore, CNNMoney.com senior writer, February 25 2008

In his final year as chairman of the Federal Reserve, Alan Greenspan repeatedly talked about a "conundrum" in the markets. He was referring to the fact that rates for the 10-year U.S. Treasury and 30-year mortgages remained low even as the Fed jacked its key short-term federal funds rate from 1% to 4.5%.

But long-term rates are once again moving in the opposite direction of the Fed: the yields on the benchmark 10-year Treasury note and fixed-rate mortgages are higher now than where they were in late January.

This could add to pain in the housing market...or be cause for optimism. It depends on who you ask.

Keith Gumbinger, vice president of mortgage tracking service HSH Associates.com, says the rise in longer-term rates is not an unexpected or even an entirely unwanted phenomenon.

After all, a yield of under 4% for the 10-Year is still historically low.

But Kevin Giddis, managing director of fixed income at Morgan Keegan, said the rise in long-term yields could also be a sign that bond investors are worried the Fed will go too far with rate cuts and that this could lead to more inflation in 2009.

Central bankers now operate in a world where monetary policy influences

only a small part of the fluctuations in overall liquidity in the economy.

“Endogenous liquidity”, or the extent to which the market itself expands and contracts liquidity,

has taken over as the main driver.

Mohamed El-Erian, FT January 16 2008

The writer is co-chief executive and co-chief investment officer of Pimco.

He was previously president and CEO of Harvard Management Company

As a result, successive interest rate increases did little to contain excesses during the expansion in market liquidity that came to an end last summer – a phase turbo-charged by financial innovation and alchemy. Today, interest rate cuts are having difficulty countering the forces of endogenous liquidity contraction that are being accentuated by the impact of the large losses at many financial institutions.

Central Bank's monetary policy was not the primary cause of

the persistant decline in inflation and long-term interest rates

Alan Greenspan, The Age of Turbulence, p. 14

Tim Iacono: Good afternoon.

Alan Greenspan: Good afternoon. My assistant tells me you've been writing about me.

Iacono: A little. Let's get right to the point. Are you responsible for the housing bubble?

Greenspan: No.

Iacono: Would you care to elaborate on that?

Tim Iacono 4/10 2007

There was an absolute rout today in bonds, not just in the US but globally.

Treasury trendlines are now clearly broken in several major countries.

Following is a chart of the 30 year bond

For 20 years, bond yields have been falling steadily.

This reflects growing confidence that inflation has been squeezed out of the world economy.

Yields have fluctuated, but the peak of each cycle over the last two decades has been lower than the peak that preceded it.

Those peaks formed a perfect downward trend line. The straight line perfectly crosses all the peaks.

“The trend is your friend.”

That is an old saw on the market, and it has made many rich.

When the trend breaks, you have nothing to hold on to. That is when panic ensues.

John Authers, Financial Times, June 8 2007

The yield on the 10-year US government note hit 5.14 per cent

in New York trading, marking the biggest one-day advance in several years, before settling back to 5.10 per cent.

That brought 10-year yields above those on shorter-term Treasuries, restoring a more normal – that is, “steeper” – yield curve.

For much of the past year and a half, longer-dated notes have offered lower yields than shorter-duration bills, creating a “conundrum”, as Alan Greenspan, then chairman of the Federal Reserve, put it in 2005.

FT June 8 2007

By the Fed's own admission, the growth of global liquidity has reduced the U.S. central bank's ability to control interest rates -- and thus the economy -- in the United States. Think about this: The Fed raises short-term interest rates relentlessly from their 1% low in June 2003, and yet long-term rates sink as global cash flows overwhelm the Fed's domestic policy shifts.

Jim Jubak 5/6 2007

Very unusual things going on now

Alan Greenspan said the prevalence of low interest rates throughout the world was one of the things that surprised him as he prepared

his reflections on his past for the new book he was promoting, "The Age of Turbulence."

CNN June 1 2007

OPEC nations are unloading Treasuries at the fastest pace in more than three years as crude oil prices tumble, sending bond yields higher.

Members of the Organization of Petroleum Exporting Countries last sold Treasuries for three straight months in June 2003.

Bloomberg 22/1 2007

Moral Hazard Interruptus

the Peoples Bank of China (PBOC), the Bank of Japan (BOJ) and the Federal Reserve

Paul McCulley, PIMCO, June 2006

A price index for personal consumption expenditures excluding food and energy rose 0.2% in April, meeting expectations. However, the unrounded number was 0.24968%, failing to calm inflation concerns.

Wall Street Journal 26/5 2006

Bernanke’s Sophie's Choice:

"The housing market or stock market Mr. Bernanke. You may only be able to try and save one..."

Brady Willett, May 18, 2006

wikipedia.org/wiki/Yield_curve

Mr Powell’s testimony suggests he that he understands the risks if the signal from the yield curve proves accurate.

What some investors fear is that he may not act on them before it is too late.

FT 19 July 2018

Bear market won’t come until the yield curve says so: Kleintop

Says Jeffrey Kleintop, chief market strategist at LPL Financial:

the yield curve has a perfect track record of predicting the top of the stock market over the past 50 years,

and it’s not signaling a bear market right now.

MarketWatch, May 13, 2014

The yield curve is another way of describing the difference between short-term Treasury yields and long-term yields.

The Writing Is On The Wall

The "Shiller P/E" shows that U.S. equity valuations are pushing towards crash-worthy levels.

This measure of long term earnings power to current price is currently at 25.3x,

or close to 2 standard deviations away from its long run median of 15.9x

Tyler Durden, zerohedge, 12 May 2014

Economist Paul Kasriel

a recession indicator that has called six consecutive recessions with no misses

Michael Shedlock 30/3 2007

The yield curve inverted significantly last fall;

and if past performance is indicative of future results, the studies suggest

we should see a recession as early as the late second quarter of this year, or more likely in the third quarter.

Note: we have never had an inverted yield curve as we currently have without a recession following within about 4 quarters.

John Mauldin 16/2 2007

What could be the problem? As I have written for the past few months, I think the culprit is going to be the housing market. Both as a result of a slowdown in construction which will modestly increase unemployment, but more importantly as a result of a decrease in the ability of the US consumer to borrow against their home as home values go flat or fall and mortgage lenders have to tighten up the credit standards. This is going to put a constraint on consumer spending, and that is going to be enough to tip us into what I think is going to be a mild recession.

In the past 40 years, there have been eight instances where the yield curve (10-year T-bond minus 3-month T-bill) has flattened to this extent.

In four of those instances, the yield curve temporarily widened, only to flatten again:

1973, 1989, 1998 and 2000. But in only one of those eight instances was the economy able to avoid a recession.

What made 1998 unique? It could be called a hedge fund named Long-Term Capital Management.

The August near-meltdown on Wall Street, along with the lowest inflation rate in 10 years, prompted the Federal Reserve to cut interest rates twice in the fourth quarter of that year. As we see it, the Fed has no such leeway this time around.

James B. Stack, InvesTech Research 06.06.06

Reflections on the Yield Curve and Monetary Policy

Since June 30, 2004, the overnight interest rate has moved up 3-1/2 percentage points, but the ten-year nominal Treasury yield has only edged higher. At less than 4-3/4 percent, that yield is not much above the target federal funds rate of 4-1/2 percent

Chairman Ben S. Bernanke 20/3 2006

What does the historically unusual behavior of long-term yields imply for the conduct of monetary policy?

Although macroeconomic forecasting is fraught with hazards, I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come, for several reasons.

Once the 30-year bond is back it will almost certainly complete the inversion of the long end of the yield curve.

It means that the bond market appears to be betting on a recession.

Jennifer Hughes, Financial Times, 9/2 2006

Normally the curve slopes upwards. This makes sense as investors would be expected to require a higher yield to compensate them for the greater risk and uncertainty of investing over a longer term.

When the curve inverts, or slopes downward, however, it implies investors believe growth will slow and inflationary pressures will weaken. In other words, they believe the central bank will be forced to cut interest rates to prop up the economy. And that means they believe the economy is heading towards recession.

Appetite for the UK’s ultra-long paper is so strong that nominal 50-year gilts currently yield just 3.8 per cent and 50-year inflation-linked notes were offered last month with a yield of just 0.46 per cent more than inflation.

An inversion of three-month and 0-year yields has preceded each of the last six recessions. Since the 1970s there has been only one false signal. That was in 1998 when the markets were shaken by Asian currency turmoil, Russia’s default and the implosion of the Long Term Capital Management hedge fund. Recessions tend to lag an inversion by four to five quarters, meaning any inversion implies a recession next year.

Full text of this excellent article

I religiously read Bill Gross of PIMCO. I particularly enjoyed this month's piece. Gross is talking to his clients about the problems of bond investing. Given that he sits on top of the biggest pile of bonds in the world, I find it always useful to pay attention to him.

John Mauldin, 3/4 2006

1896 presidential candidate William Jennings Bryan, for instance, railed against Wall Street's "cross of gold" and decades later FDR threatened "to drive the money changers out of the temple." More recently and perhaps indicative of the changing times, Bill Clinton shifted his venom from a Biblical reference to one closer to the linguistic gutter when he promised that his budget wasn't going to be "held hostage to some *@?#»! bond traders."

When one can buy a U.S. agency guaranteed FNMA mortgage at a higher yield than almost all emerging market debt, then there exists an irrational pricing of credit. In general, almost all risk and associated "premia" are now trading at illogically low levels and as Alan Greenspan warned just months ago, history has not dealt kindly with the aftermath of protracted periods of low risk premiums. "Periods of relative stability" in fact, "often engender unrealistic expectations of permanence and at times lead to financial excess and economic stress," he said.

This historical 12-18 month lag between a tightening cycle/flat yield curve is what fools many analysts into thinking that yields are still stimulative and that the Fed has more wood to chop.

Bill Gross january 2006

It takes that long for higher yields to affect the housing market, mortgage equitisation, and corporate investment cycles, whereas many economists feel it should work more like an anesthetic in the operating room where the patient counts backwards from 10 to 1 and is out before he reaches 5. It doesn’t work that fast. The Fed knows this, but often is willing to risk an overshoot and a curve inversion in order to insure benign inflation and sufficient economic slack over the foreseeable future. Short rates can always be lowered quickly (and they are - within an average 6 months after the last hike) if the economy seems to be slowing too rapidly.

The yield curve has been the single most reliable predictor of recessions.

John Mauldin 30/12 2005

Professor Campbell Harvey of Duke was the one that wrote about the relationship between recessions and the yield curve, and proved that the yield curve outperformed other forecasting tools in his 1986 dissertation at the University of Chicago. He published his dissertation in 1988 in the Journal of Financial Economics. In 1989, he published a follow up piece in the Financial Analysts Journal. Estrella (we'll read more about him later) and Hardouvelis picked up on the idea and published an article in 1989 and a few more. Harvey's prediction about the usefulness of the yield curve was right on target. In 1991, after the 1990 recession he noted that inversions of the yield curve (short-term rates greater than long term rates) have preceded the last five US recessions, suggesting that the curve can accurately forecast the turning points of the business cycle.

The flattening of the yield curve has been much talked about lately

Tim Iacono with good links 19/12 2005

The biggest secret during the past few years in the bond market has been why intermediate and long-term interest rates have remained so low in the face of a 300 basis point uplift from the Federal Reserve.

Today's short rate of 4% is really equivalent to 6% in my view,

a rate that was only 50 basis points shy of the cyclical tightening peak of 6½% in 2000.

Bill Gross, Mauldin's Outside The Box 5/12 2005

Globalization, demographics and central bank transparency are difficult trends to reverse and will likely be compressing yields in 2010 much like they have in 2005. That is why discretionary bond investors like PIMCO are comfortable in investing clients' money at a 4½% 10-year Treasury rate instead of waiting for 6% which may have been a more "normal" yield during the investment frenzy of the dot-com years or the less than "transparent" central bank policy years of the 1980s.

The extraordinary importance of American interest-rate policy.

Buttonwood, The Economist 15/11 2005

The solution to the conundrum of why rising short rates have not led to higher yields at the long end is this paradox: in order to raise rates, the Fed must stop raising rates.

Eleven successive rate increases have failed to budge intermediate and long rates, an unprecedented situation.

It is time for the Fed to quit trying to force up long-term rates with anti-inflation hikes in short rates, which the market believes will indeed prove prophylactic against inflation, and opt instead for steady short rates, which would let rising inflation expectations lift long-term rates and temper speculative fervour in property markets.

Bill Miller and Paul McCulley, Pimco October 2005

During his tenure at the Fed, Chairman Greenspan has proven himself an able pragmatist in the best tradition of philosopher William James, who authored “Pragmatism” in 1907. In the mid to late 1990s Greenspan noted that economic models were failing to account for the economic environment then unfolding. Rather than being the slave of defunct models, he adopted a market-based approach to Fed policy, changing course when circumstances seemed to dictate.

Top

“it’s different this time”

Because the U.S. economy has evolved into a highly levered finance-based economy, it stands to our reason that this modern day version is more sensitive to changes in interest rates than those of years past.

PIMCO has for several years now focused on the real interest rate – Fed Funds minus inflation – as the most legitimate indicator of neutrality.

Bill Gross, November 2005

The increasing attention paid to growing U.S. current account deficits has bred nightmare scenarios of a sharp decline in the foreign-exchange value of the dollar and rising U.S. interest rates.

Financial markets, by contrast, appear more sanguine. Inflation-indexed bonds in the U.S. are yielding only about 1.5% in real terms, and the IMF's estimate of the long-term world real interest rate is about 2%.

Glenn Hubbard, dean of Columbia Business School, was chairman of the Council of Economic Advisers under President George W. Bush,

Wall Street Journal, 23/6 2005

Mr. Altman served as deputy Treasury secretary in the first Clinton administration.

The 'Conundrum' Explained

Believe it or not, comparable rates outside the U.S. are even lower than ours

That is why this excess foreign liquidity has nowhere else to go.

Roger C. Altman, Wall Street Journal, June 21, 2005

In recent months, one overriding debate has raged within the world-wide financial community. How can long-term U.S. interest rates be so low? And how can so many economists have been so wrong on their interest rate forecasts?

No less a figure than Alan Greenspan, chairman of the Federal Reserve Board, famously described this question as a "conundrum" in congressional testimony earlier this year.

It is stunning for the head of our central bank to describe himself as mystified by the behavior of overall rates. But he has plenty of company.

This observer cannot recall a bigger disconnect between conventional wisdom and market reality on such a central issue.

The pronounced decline in U.S. Treasury long-term interest rates over the past year despite a 200-basis-point increase in our federal funds rate is clearly without recent precedent.

Moreover, despite the recent backup in credit risk spreads, yields for both investment-grade and less-than-investment-grade corporate bonds have declined even more than Treasuries over the same period.

Remarks by Chairman Alan Greenspan, Beijing, June 6, 2005

The economic and financial world is changing in ways that we still do not fully comprehend.

In his testimony to Congress on July 20, 2005, Mr. Greenspan declared it quite likely that the world is currently experiencing a global savings glut. Agreeing with Ben Bernanke, he mentioned this glut as one of the factors behind the so-called interest conundrum, i.e., declining long-term rates despite rising short-term rates.

Having read a lot from the Fed's luminaries, their inability to distinguish between rampant global credit excess and a global savings glut does not surprise us.

Kurt Richebächer, 17/9 2005

In this view, the Federal Reserve has come to the rescue of a world where excessive saving is threatening depression by eliminating savings.

The world economy seems to be flooded with liquidity. But there are two diametrically different kinds of liquidity: earned liquidity and borrowed liquidity. The former comes from surplus income or savings; the latter comes from credit and debt creation. In a country with virtually zero savings like the United States, any liquidity essentially arises from debt creation. This is really fake liquidity depending on permanent, prodigious borrowing facilities, presently the housing bubble. Once this bubble evaporates or bursts, the U.S. economy loses its chief liquidity source - with disastrous effects on asset prices.

Former Fed Chairman Paul Volcker once said: "Sometimes I think that the job of central bankers is to prove Kurt Richebächer wrong."

The Fed’s recent monetary approach, combined with the US Treasury’s practice of confining much of its new borrowing to short- and intermediate-term notes, explains a great deal of what the Fed has dubbed a “conundrum”

Henry Kaufman, Financial Times, 2/8 2005

In short, the Fed’s recent monetary approach, combined with the US Treasury’s practice of confining much of its new borrowing to short- and intermediate-term notes, explains a great deal of what the Fed has dubbed a “conundrum” – namely, the sharp increase in short rates in the face of declining long-term yields

Strange things are happening in the world economy: falling interest rates on long-term securities, declining spreads between returns on safe and riskier assets, large fiscal deficits and huge global current account “imbalances” should not, in normal circumstances, coincide. So what is going on?

The answer, in a nutshell, is a global excess of desired savings against the background of weak investment, low inflation and ever more integrated economies.

To understand the present we need to go back to the 1930s. The “paradox of thrift” was the most counterintuitive and, to the classically trained economist, morally, theoretically and practically objectionable idea in John Maynard Keynes’ General Theory of Employment, Interest and Money, published in 1936, in response to the Great Depression.

Martin Wolf Financial Times June 13 2005

In Treating U.S. After Bubble, Fed Helped Create New Threats

Low Rates Bolstered Economy, But Housing, Foreign Debt Appear Out of Balance

Greenspan's Legacy at Stake

Greg Ip, Staff Reporter of The Wall Street Journal, June 9, 2005

The interest rate conundrum is challenging enough. But now the dollar is springing back to life in the face of America’s record current account deficit.

In my view, this defies both the history and the analytics of the classic current account adjustment.

Stephen Roach 3/6 2005

Stephen Roach turns 180 degrees

I now suspect bond yields will stay low for the foreseeable future

I continue to believe this is ultimately a recipe for disaster.

Stephen Roach May 31, 2005

Since June 2004, the Fed has raised its short-term rate target to 3% from 1% and has signaled plans to raise it further,

while the 10-year Treasury bond yield has fallen to less than 4% from 4.7%.

That sort of decline in long-term rates "is clearly without recent precedent," Mr. Greenspan said via satellite to the International Monetary Conference, a meeting of bankers from around the world, in Beijing.

Wall Street Journal 7/6 2005

The low interest rates that rescued us from the last recession might be the cause of the next

William Rhodes, senior vice chairman of Citigroup, puts it this way: "The speculation here is more evident than people seem to realize. . . . I've seen this movie."

Robert J. Samuelson, June 2, 2005

The present recovery is built largely on cheap credit. Striving to prevent a punishing recession after the 1990s' stock "bubble," the Federal Reserve lowered interest rates. The federal funds rate (the rate on overnight loans between banks) dropped to 1 percent. That policy worked. Americans borrowed heavily, particularly for housing. The result was a construction boom and a helpful rise in home prices. The higher housing values fortified confidence and provided -- through the refinancing of mortgages at lower rates - huge cash windfalls that fueled consumer spending.

"Bubbles," as we've learned, do ultimately pop.

If something goes wrong in the United States, it could spread globally. Everything is interconnected. Hedge funds own mortgages, junk bonds and emerging-market bonds. Losses in one market can cause losses in others. Of course, that's normal. But will the normal trigger something more threatening?

The Real Interest Rate Conundrum

Stephen Roach January 18 2005

Real, or inflation-adjusted, interest rates remain near rock-bottom levels. That’s true in most major segments of the world. It’s also true for short- and long-term maturities, alike. This condition is not sustainable. The days of abnormally low real interest rates could be coming to an end. As the world economy returns to trend, a normalization of real interest rates is both appropriate and likely. This poses major risk to financial markets, as well to asset-dependent real economies that have become hooked on low real interest rates.