The Economist's explanation

NAIRU

Wall Street Bubbles

Home

See also: Hard or Soft Landing

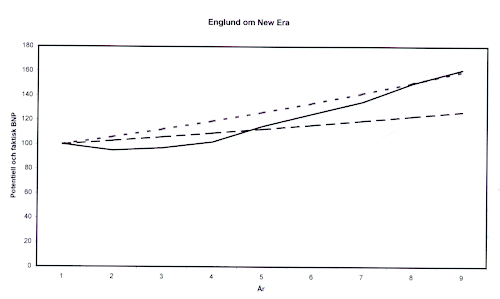

Rolf Englund about New Era, June 29, 1999

Many people say that we are in a New Era, where the porridge is neither too cold, neither too warm, and that is why we now, at least in the US, can have high growth without inflation.

In the New Era Keynes is dead.

But there might be an alternative explanation that is close to the Old Teachings.

When Demand is higher than Supply, the Price will rise. Even Economists probably could agree on that.

Why then is there no inflation in USA?

First, of course it could be that the high demand is met by imports resulting in a trade deficit of about 20 bn dollars each month.

But the Economy could also have changed. The Potential GDP/BNP, which in the old socialdemocratic days in Sweden (and with Reagan in the US) without computers, we thought could expand with only, let us say, 3 procent annually.

But now, with Clinton and Supply Economics and computers and with the clever policies of Dennis, Feldt, Bildt, and Wibble, the potential GDP can now rise by, let us say, 6 percent annually, without anybody noticing that or when the change took place.

That means that the economy (the actual GDP can deviate from the potential GDP, as we noticed in Sweden around 1992-1993) can now rise above the old potential GDP without unleashing inflation.

But the actual GDP is still below the new potential GDP, so there should be no inflation either.

Keynes should agree on that, I believe.

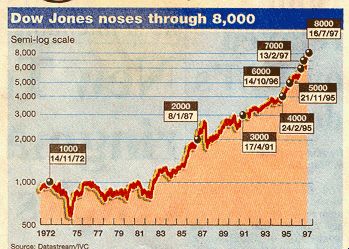

It is highly recomended that you study the Chart below

Thank You for Your interest.

Denna artikel är, tycker jag, en av mina bästa - klicka här för fler av mina bästa opus.

Three years ago, at the height of the stock bubble,

Paul Volcker, Mr

Greenspan's predecessor as Fed chairman, issued a famous warning:

that the

world economy was dependent on the US economy, which was dependent on the stock

market, which was dependent on fifty stocks, half of which had never reported

any earnings. (FT.com site; Jul 19, 2002)

Illusory profits cloud USA Inc

Sunday, 30 June,

2002

Nearly a year ago, Graham Turner warned that the US economy was driven

by a huge bubble of artificially inflated profits. Writing for BBC News Online,

he explains why the Enron, WorldCom and Xerox scandals are just the tip of the

iceberg.

Full

text

The bursting of the real estate bubble and the ensuing recession have hurt jobs, home prices

Social Security will pay out more in benefits than it receives in payroll taxes,

an important threshold it was not expected to cross until at least 2016,

according to the Congressional Budget Office

NYT, March 24, 2010

Visst finns hoten där i form av en konjunkturnedgång, höga energipriser och svagare USA-ekonomi. Men den huvudsakliga bilden är att den internationella ekonomin kör på hög växel och kommande år väntas den höga tillväxten hålla i sig, enligt förra veckans prognoser från Internationella valutafonden.

Cecilia Skingsley, DI 2006-09-18

Det är ett gyllene läge som väntar Sveriges nästa regering. Om man vill genomföra långsiktiga reformer av ekonomin kan omständigheterna knappast bli bättre än under den här mandatperioden.

The difference between the benign scenario of a soft landing and a collapse in house prices with a spillover to the financial sector is enormous.

Bubbles eventually burst and economic forecasts implode when bubbles explode.

Wolfgang Munchau, FT 18/9 2006

General Motors shares have fallen to their lowest level in more than 53 years

Merrill Lynch warned that GM needs to raise funds and that bankruptcy was "not impossible"

BBC July 3, 2008

On news that Goldman Sachs reduced General Motor's rating to "sell",

their shares have plummeted to less than $12, the lowest level since 1955.

That means the world's largest auto maker has a stock market value of only about $7 billion.

CNBC 26/6 2008

Deepening gloom at General Motors

Alex Taylor III, senior editor, CNN,June 19, 2008

The sales slump is digging a far deeper hole than seemed possible just a few months ago. June is shaping up as a full-fledged disaster. Expectations are that U.S. sales of cars and trucks will run at an annual rate of 12.5 million, as compared with 16.3 million last year and 15.2 million for the first quarter of 2008.

G.M. restated five years of financial results and reported that it lost $2 billion in 2006

— a significant improvement over the previous year’s $10.4 billion loss

but a sizable negative number nonetheless.

NYT 16/3 2007

General Motors, a company once known as the model of corporate accounting, warned investors on Thursday that its performance was threatened by “ineffective” controls over financial reporting, including inadequately trained personnel and failure to obtain management’s approval for some transactions.

I think it important to recognize that General Motors is a canary in this country’s economic coal mine;

a forerunner for what’s to come for the broader economy

Bill Gross, Pimco, May 2006

The current attempt on the part of GM to address the high cost of its labour draws a comparison to potential future U.S. efforts to do so via currency devaluation. While a company must deal directly with its employees and or its unions in order to lower wage/benefit expenses, a country – certainly a capitalistic oriented one – goes about it in another way. By depreciating the dollar, U.S. Treasury or Federal Reserve policies aimed in that direction explicitly do the same thing. Such policies make our products cheaper to buy than those of competitor nations. In terms of global purchasing power experienced by America citizens, a significantly lower dollar in turn leads to declining real wages which is the ultimate consequence in order to restore competitiveness.

Owners of these liabilities (either existing/future debt holders, or tax paying corporations/citizens) will likely be the sacrificial lambs of the future. Investors, therefore, should factor in an increasing propensity for higher inflation in future years as debt principal is eroded much like the shaved edges of a Roman coin. Higher taxes, as well, are just around the corner.

General Motors has launched a time bomb that could push the company into Chapter 11

- and take down the financial markets with it.

Jim Jubak, CNBC 11/4 2006

Thanks to their most recent "solution" - selling off a 51% stake in the company's profitable General Motors Acceptance Corp. financial arm - CEO Rick Wagoner and his team have actually raised the odds that General Motors will have to seek bankruptcy protection. And made sure, as an added bonus, that they can do nothing to stop what they’ve set in motion.

Factor-price equalization - Faktorprisutjämning

Less like a titan and more like the Titanic, holed below the water-line, sinking slowly by the bow to the sound of loud shocks and bangs as bulkheads give way, one after the other.

The chief executive on the bridge, Rick Wagoner, can rush around and bark orders, but to little effect.

The Economist 18/11 2005

Rick Wagoner, chairman and chief executive of General Motors:

“I’d like to just set the record straight here and now,” - “There is absolutely no plan, strategy or intention for GM to file for bankruptcy.”

Financial Times, November 17 2005 15:35

Can GM be saved?

At the heart of the issue is whether or not GM's pension funds are fully funded now.

Michael Shedlock, 16/11 2005

The problems at GM continue. Its stock price is near 52 week lows and GM is reportedly looking to sell a stake in its consumer financing unit to raise some $11-15 billion dollars to fund operations.

Not so fast says the Pension Benefit Guaranty Corp. It seems The PBGC may seek additional pension funding from GM to safeguard against a taxpayer bailout should GM go bankrupt sometime down the road according to the Wall Street Journal article Pension Agency Casts Shadow on GM Sale.

GM claims that its pension plans are fully funded. The PBGC calculates that the plans are underfunded by an estimated $31 billion. Technically both are correct under the arcane rules that govern pension accounting. On a practical basis, however, the PBGC is correct: GM's pension funds are enormously underfunded.

It’s often forgotten that when Bush come to power in early 2001 the US economy was in recession. Since then there has been three waves of tax cuts – the last in 2003 – and a remarkable improvement in the performance of the US economy.

More than 4 million new jobs have been created, and unemployment has dropped below 5 %. Productivity has been increasing very fast. And the federal budget deficit has started to shrink as a result of the rapid growth in tax income.

Even with the very high rates of increase in federal spending, on present trends the federal budget might well be in balance by 2008.

Carl Bildt blog 13/11 2005

Since December 2000 employment in U.S. manufacturing has fallen 17 percent, but /antalet fastighetsmäklare/ membership in the National Association of Realtors has risen 58 percent.

So it's an economy driven by real estate. What's wrong with that? One answer is that it has been a pretty disappointing recovery.

Paul Krugman, New York Times 12/8 2005

Top of page

As Boomers Retire, a Debate:

Will Stock Prices Get Crushed?

In speeches and a new book, he is warning that a flood of boomer retirees with trillions of dollars of assets to sell over the next 20 to 40 years threatens to crush stock and bond prices.

Jeremy Siegel, the Wharton School finance professor well-known until now for recommending stocks as a long-term investment.

Wall Street Journal 5/5 2005

I am not a believer in conspiracy theories. But

In all my years in this business, never before have I seen a central bank attempt to spin the debate as America's Federal Reserve has over the past six or seven years.

From the New Paradigm mantra of the late 1990s to today's new theories of the current-account adjustment, the US central bank has led the charge in attempting to rewrite conventional macroeconomics and in making an effort to convince market participants of the wisdom of its revisionist theories

It is a concentrated effort on the part of the Fed to exonerate itself from the Original Sin of failing to address asset bubbles. The result is an ever-deepening moral hazard dilemma that poses grave threats to financial markets.

Stephen Roach - Morgan Stanley Global Economic Team -

April 25, 2005

Out of that pivotal moment in the late 1990s, a New Economy actually did come into being. But it was not the new economy of ever- accelerating productivity growth that infatuated the New Paradigm Crowd and legions of equity-market speculators. Instead, it was the Asset Economy that enabled consumers and businesses to draw on the pixie dust of a new source of purchasing power -- asset appreciation -- as a means to augment what has since turned into a stunning shortfall of organic domestic income generation.

Unfortunately, the asset-based spending model has given rise to many of the distortions and imbalances evident in the US today. That's especially true of low saving rates, the housing bubble, high debt loads, and a runaway current account deficit.

Since it takes 150,000 jobs a month just to keep up with the birth rate and immigration, anything less than that and we are actually losing jobs no matter what the hype from CNBC says.

A quick glance at the chart clearly shows that jobs have not kept pace with the birth rate in 16 out of the last 23 months.

Mish's Global Economic Trend Analysis 6/4 2005

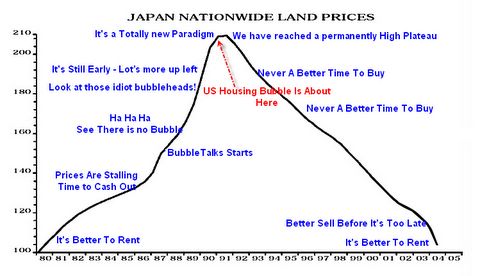

It's a Totally New Paradigm

Talk of "new paradigms" or "new economic models" has been associated with every major bubble in history, typically near the peak.

Mish's Global Economic Trend Analysis

Thoughts on the great inflation/deflation/stagflation debate as well as discussions on commodities, currencies, interest rates, and policy decisions that affect the global markets

Talk of "new paradigms" or "new economic models" has been associated with every major bubble in history, typically near the peak.

Wasn't it just 5 short years ago that Greenspan proclaimed the "productivity miracle" and everyone was counting "clicks" on dot coms as the "new economic model"?

Top

In an environment in which profits, business success, and jobs themselves have been driven in substantial part by a 20-year trend of lower interest rates, an observer must make the unmistakable conclusion that we have come to the end of the road.

Age does have some benefits if only in knowing what not to do if given a second chance.

PIMCO Founder and CIO Bill Gross addressed the graduating MBA class at Duke University's Fuqua School of Business on May 8, 2004.

In an environment in which profits, business success, and jobs themselves have been driven in substantial part by a 20-year trend of lower interest rates, an observer must make the unmistakable conclusion that we have come to the end of the road. 1% short rates have nowhere to go but up, (that is for certain) and nearly as certain is a similar conclusion for interest rates further out along the yield curve. Joining this near slam dunk forecast with the observation of historically high leverage in our finance-based economy leads one to conclude that the bloom of capitalism’s rose will surely come off over the next few years. We will all pay in some form or fashion, whether it be via higher inflation, subdued returns on stocks and bonds, a depreciating dollar, or a loss of competitive influence relative to our capitalistic competitors.

When the Federal Reserve raises interest rates, trouble usually follows.

In 1987, the stock market crashed. In 1994, Orange County went bankrupt and Mexico devalued its peso, ravaging its economy. In 2000, the Nasdaq Stock Market bubble burst.

Others think it will be different this time.

Wall Street Journal 20/3 2005

One of my deepest concerns is that the current complacency with the trade deficit which stems from the relative stability of the US economy and markets will lead to an event as dramatic as the fall of the NASDAQ.

The US economy is growing handily, thank you very much, and unemployment is slowly beginning to drop. The trade deficit has caused no problems.

John Mauldin 11/3 2005

There are many who now suggest we are in a New Paradigm. This time, we're told, things are different.Mauldin's Fourth Rule: It is almost never different. And if it really is different, we won't know it is until long after. You can't alter the basic economic equations of mankind.

Household debt now totals about $10 trillion, or roughly 115 percent of personal disposable income.

In 1945, debt was about 20 percent of disposable income.

Robert J. Samuelsson Washington Post 29/12 2004

Household debt -- everything from home mortgages to credit cards -- now totals about $10 trillion, or roughly 115 percent of personal disposable income. In 1945, debt was about 20 percent of disposable income.

For six decades, consumer debt and spending have risen faster than income.

Den nya ekonomin är här för att stanna. Åtminstone under ett decennium till.

Lars-Georg Bergkvist SvD Näringsliv 18/12 2004

De senaste årens starka, teknikdrivna produktivitetsökning i USA är inte någon tillfällighet. Det är den hoppingivande slutsatsen i en ny studie som gjorts av tre välkända amerikanska ekonomer - Dale Jorgensen, Mun S Ho och Kevin Stiroh - på uppdrag av Federal Reserve i New York ("Will the U. S. Productivity Resurgence Continue?").

det beror på att den nya informationsteknologin har haft ett så stort och djupgående genomslag i näringslivet att det lyft tillväxtförutsättningarna för hela den amerikanska ekonomin. Det är också en slutsats som Fedchefen Alan Greenspan - som framstått som "den nya ekonomins banerförare" här i USA - gång på gång betonat.

USA förblir under överskådlig tid framöver den globala ekonomins viktigaste motor. Och med en fortsatt, stark produktivitetsökning är förutsättningarna för en uthålligt hög ekonomisk tillväxt i USA mycket goda.

The solution is a tax rise

Stephen Cecchetti Financial Times November 23 2004

The writer is professor of international economics and finance at Brandeis University and research associate at the National Bureau of Economic Research

As the Bretton Woods system of fixed exchange rates was collapsing in 1971, John Connally, the US treasury secretary, famously said: "The dollar is our currency, but it's your problem." In the intervening three decades many things have changed, and that is one of them. Today, the dollar is an American problem as well.

Five years ago, the stock market was booming and the federal government budget was in surplus. Then, the current account deficit could be explained as reflecting the capital flowing into the US because foreigners saw it as a good place to invest.

What is surprising is not that the dollar has fallen, but that interest rates have not increased.

The mystery can be solved by looking at the behaviour of central banks, especially in Asia. According to the Bank for International Settlements, in 2003 the world's central banks increased dollar reserves by $441bn, or 83 per cent of the US current account deficit. Since euro-area central banks were net sellers of dollar reserves, it is clear that the Japanese and Chinese were buying US treasury bonds. Maybe it is just a coincidence, but the foreign increase in dollar reserves roughly matches the federal government's budget deficit. To put this bluntly, the Japanese and Chinese financed the Bush administration's deficit in 2003.

Given that these reserves are huge - more than $800bn in Japan and more than $500bn in China - the potential losses are big, as is the potential embarrassment. A 10 per cent appreciation of the renminbi means a capital loss of $50bn for Chinese authorities. Assuming the duration of their bond portfolio is three to five years, a 2 percentage point increase in US interest rates means another loss of $30bn-$50bn.

The solution is a tax increase. This will decrease domestic consumption, reducing the current account deficit, reduce the issuance of treasuries, and make the US a good place for long-term investment the way it was in the 1990s. Only then will the dollar stabilise and the risk of a dramatic interest rate increase be reduced.

If the US government does not do something soon, it will experience the fate of Latin American countries and suffer a financial meltdown. Dollar depreciation is just the beginning. The foreign exchange traders are doing reconnaissance for the bond vigilantes. If nothing changes, watch out.

The perils of ignoring bubbles

Stephen Cecchetti Financial Times, September 3 2002

The Next Bush Recession?

An Open Letter to Karl Rove

By John Mauldin November 6, 2004

Bush did the right thing for the economy during the last recession. He lowered taxes again and again. Luckily, the Fed had plenty of ammunition to fight the recession, aggressively lowering interest rates and avoiding deflation. The consumers helped by refinancing against their home values, resulting in the very positive twin combination of lower mortgage payments and cash-out borrowing, allowing them to spend more than they made. Even in the face of 9-11 and massive debt and trade imbalances, the combination of such massive stimulus helped engineer a very shallow recession.

The problem is that we will not have these recession fighting tools when we enter the next recession. Interest rates will likely be no more than 3%. Even cutting rates to zero will not be much stimulus, as the last 1% is mostly psychological. If a deal can't get done with interest rates at 1%, it is unlikely to get done at 0%. As much as I would like, there are no more tax cuts available which would provide any significant stimulus. Mortgage rates would have to drop to 4.5% or lower to allow home owners to re-finance and lower their costs. However, such low rates would indicate that we would already be in a much worse recession than last time.

You might read a paper by Dr. Ben Bernanke of the Fed and then call him up for lunch and get his private take. Oh, and ask about how they would deal with the potentially massive losses of money by the Fed when they fix ten year rates and rates eventually go back up. Who pays? The US Treasury as one Fed paper suggested? The conspiracy crowd will go nuts over that one.

(You probably know Dr. Lacy Hunt of Hoisington Management from your Austin days. He's one of the best and brightest economists around. Call him up and ask him for a few thoughts on what the yield curve is saying about the economy.)

How can we be sure we don't have a recession coming in 2005?

Achieving only trend growth required tax cuts and a negative real fed-funds rates that generated record low mortgage rates and cash out refinancings

John Makin, Wall Street Journal 19/10 2004

Achieving only trend growth required tax cuts and a negative real fed-funds rates that generated record low mortgage rates and cash out refinancings worth $100 billion annually. Also, oil prices stayed down until the second half of 2003.If with all that stimulus and low oil prices, we managed just 3.5 percent growth, how can we manage the 5 percent growth the Fed predicted last July as it started raising the federal-funds rate? Indeed, now that the fed-funds rate is up to 1.75 percent, tax cuts are over, "refis" are down, and oil prices are up $25 a barrel since the second half of 2003, how can we be sure we don't have a recession coming in 2005?

The drop in inflation to 1 percent would mean that the real fed-funds rate has already risen to 0.75 percent, still low, but in the context of the past several years, still possibly too high to support trend growth, especially given the withdrawal of other stimulus coupled with a substantial oil tax.

The Fed needs to sharply re-examine its concept of the current neutral real fed-funds rate. The evidence of the past several years suggests that the neutral real fed-funds rate for the post-equity-bubble U.S. has been closer to 0 percent than 2 percent, so any increases in the fed-funds rate above current levels should be undertaken only after careful examination of an appropriate rate.

The rationale sometimes heard, that the Fed needs to raise the fed-funds rate in order to have the leeway to cut it in the future, is essentially silly if such rate increases themselves lead only to the need for future rate cuts.

We don't need a recession to tame inflation - the usual rationale - and we certainly don't need a recession that reignites deflation risks.

Does the US budget deficit matter?

BBC 9/9 2004

US consumer spending rose 0.8% - incomes rose 0.1%

BBC 30/8 2004

The vigour of America's expansion is once again in doubt

Is America's economy in trouble? With oil prices hitting new highs of over

$45 a barrel this week, and with the latest figures showing a measly 32,000 new

jobs created in July, the question is fraying nerves on Wall Street and in the

White House.

The Economist 12/8 2004

Say's Law

America Demands; China

Supplies

John H. Makin, March 19, 2004

Say's Law, named after French economist Jean-Baptiste Say (1767-1832), was promulgated at the time of the Industrial Revolution when some feared that purchasing power would be insufficient to absorb the ever-growing output of the newly mechanized economy. It states simply and reassuringly that supply creates its own demand. More specifically, the production of output tends to generate purchasing power equal to the value of that output.

The violent investment cycles and deflation that characterized the last thirty years of the nineteenth century together with America's Great Depression in the 1930s and Japan's current thirteen-year contraction have all demonstrated, if not the fallacy of Say's Law, a substantial need to modify it. Supply creates its own demand, but serious questions exist regarding the time period over which demand is created to absorb supply and the price level at which the market clears.

It is even trickier to apply Say's Law to an open economy and, in particular, to the current situation in the world economy, in which the locus of most demand growth is the United States and the locus of more and more output growth is China.

Did President Ronald Reagan really prove

that deficits do not matter? Stephen Cecchetti, Financial Times 2/2 2004

The writer is professor of international economics and finance at Brandeis

University

Dick Cheney, the vice-president, seems to think so; or at least that is what Paul O'Neill, the former Treasury secretary, reports. While the vice-president may be right on the politics of deficits, he is wrong on the economics.

He is wrong about the impact of the Reagan deficits and he is wrong about the impact of deficits today.

Voters may not care about deficits, but they should.

During the Reagan and George H.W. Bush administrations, from 1981 to 1992, the deficit averaged 3.75 per cent of gross domestic product, government expenditure ran at about 22 per cent of GDP and the inflation-adjusted real interest rate was in the neighbourhood of 4 per cent.

In the 1990s, changes in policy brought the budget into surplus, peaking at 2 per cent of GDP in 2000, with expenditure below 19 per cent of GDP. With that came real interest rates closer to 2 per cent. By lowering government spending, and especially by eliminating deficits, Bill Clinton's administration created an environment in which interest rates fell. Low real interest rates spur investment and increase long-term growth. Everyone should care about that.

In 2001 things changed. A combination of tax cuts and a sluggish economy led to a swift deterioration in the US fiscal position. The deficit now stands at 5 per cent of GDP. And expenditure is now nearly at the levels of the 1980s. As a result US government debt has risen by roughly $1,000bn.

The long-term picture is much worse. The net present value of the unfunded liabilities over the next 75 years - the amount we would need to have today to finance all the existing debt plus future deficits - is more than $50,000bn, five times US GDP.

The bulk of unfunded future liabilities are in the form of Social Security and Medicare programme expenses. Then there are the tax cuts and the new prescription drug programme. Every day brings larger estimates of how costly these are going to be, with no hint as to where the financing will come from.

US government will run up a budget deficit of

nearly $500bn in 2004 - the largest in US history in absolute terms, 5% of

GDP

BBC 27/1 2004

Highly recommended -

good links

The new economy may already be history

If productivity

continues to grow at this pace, the new economy will prove to be just a blip in

a longer period of slow growth.

By Dean Baker FT

June 1 2003

I väntan på nästa kris

Peter Wolodarski

DN 21 november 2002

Behovet av ett nytt ekonomiskt

tänkande

/ finansiella bubblor/Mattias LundbäckSvD Inblick

2002-10-04

SURVEY: THE WORLD ECONOMY

The

unfinished recession

Sep 26th 2002

The Economist print

edition

Vilken bubbla spricker

härnäst? Det amerikanska undret

Mats Johansson SvD ledarsida

1/9 2002

Bo Lundgren -

Klas Eklund -

Mats Johansson

om

Den Nya Ekonomin i USA

IMF warns US economy could slow

BBC 5

August, 2002

Livet efter baksmällan

Den nya

ekonomin var inte nyare än den gamla

DN-ledare 2002-07-26

Oron uppstår inte i ett tomrum

SvD-ledare 2002-07-26

Mellan

ekonomins avgrunder

SvD-ledare 2002-02-28

Enron for Dummies

New

York Times, January 26, 2002

Enron is a new-economy company, a

thinking-outside-the-box, paradigm-shifting, market-making company.

In

fact, it ranked as the most innovative company in America four years in a row,

as judged by envious corporate peers in the annual Fortune magazine poll.

It is also, at this point in time, a bankrupt company.

The 1990s’ Boom Went Bust.

What’s Next?

Milton Friedman

Wall Street Journal

2002-01-22

USA i kraschläge

DI:s

Cecilia Skingsley 2002-01-21

AOL Time Warner has said it will write off $54bn (£38bn) of assets in its accounts for the first three months of 2002. It will be the biggest ever corporate write-down in a single three month period - roughly equal to the gross domestic product of Pakistan, Hungary or New Zealand, analysts said. The write-down reflects the falling value of AOL's merger with Time Warner, the US media giant said in a filing to the stock market regulator.

Did Greenspan Push His Optimism About the

New Economy Too Far?

Wall Street Journal December 28, 2001

Five years ago, Alan Greenspan began pushing a reluctant Federal Reserve to embrace his New Economy vision of rapid productivity growth and rising living standards.

Today, Fed policy makers are debating whether they went too far. The answer could help determine whether the current recession marks a temporary aberration in an era of swift growth, or whether the rapid growth of the late 1990s itself was the aberration.

The

US economy, which officials have admitted has entered recession, will perform

even worse next year than in 2001.(BBC)

America's

economy, the world's biggest, will grow by 0.75% next year (OECD)

Mediocre, not miraculous /US

economy/

Financial Times editorial, 2001-11-01

med citat av

EMU-anhängarna Bo Lundgren, Mats Johansson och Klas Eklund

40 svepskäl att lämna nya ekonomin

Englund about New Era, June 29, 1999

Interesting times ahead for

all

Rolf Englund, Letters to the Editor, Financial Times, November 6,

2000

Chairman

Alan Greenspan, 4, 1998

Question: Is There a New Economy?

Nya ekonomin och bakmaskinen

Chefredaktören

Veckans Affärer nr 43/2001

The new economy may already be history

If productivity continues to grow at this pace, the new economy will prove

to be just a blip in a longer period of slow growth.

By

Dean Baker FT June 1 2003

The core of the "new economy" has always been the sharp increase in productivity growth that began in the second half of 1995. Proponents of the new economy, led by Alan Greenspan, chairman of the Federal Reserve, have focused on this upturn in productivity growth as its defining feature.

The US had a boom of investment, concentrated in information technology, which unleashed a surge in productivity growth unmatched since the 1960s.

It is therefore striking that new data, suggesting that productivity is no longer growing rapidly, have received little attention. The most recent data from the US Department of Commerce indicate that over the past year, productivity growth has fallen back to the rate of the productivity slowdown of 1973-95. I

If productivity continues to grow at this pace, the new economy will prove to be just a blip in a longer period of slow growth.

I väntan på nästa

kris

Peter

Wolodarski

DN 21 november 2002

Jag upplevde "den nya ekonomin" på Handelshögskolan i Stockholm. Vi var gott om studenter som drömde om att sälja konservburkar via Internet och samtidigt tjäna miljarder. Slutet av 90-talet var den gränslösa och vilda överoptimismens tid.

Det verkligt nya på 90-talet var snarare känslan, den aldrig sinande optimismen. Och det stora skiftet i världens ekonomier var inte Internet, utan att inflationen plötsligt försvann. På kort tid var prisökningarna i västvärlden lägre än under 50- och 60-talen, det vill säga den period som i litteraturen brukar gå under benämningen "guldåldern". Mönstret såg likadant ut i alla OECD-länder. Ingen behövde längre vara orolig för att löneökningen skulle ätas upp av inflationen, när ekonomins signalsystem åter fungerade normalt. Inköp gick att planera. Kostnader hölls i schack. I Sverige konstaterade till och med LO-ekonomen Dan Andersson att "Riksbanken är löntagarnas bästa vän".

Häri ligger förmodligen huvudförklaringen till att 90-talet bjöd på sådana tvära kast - från nattmörkret när kronan föll, till lyckoruset som kom att prägla slutet av decenniet. Med inflationen försvann också pessimismen. "Utvecklingen blev väsentligt bättre än vad vi föreställde oss", konstaterade Lars Heikensten, tillträdande chef för Riksbanken, när SNS i tisdags blickade tillbaka på de tio år som gått sedan det misslyckade kronförsvaret. Och visst ligger det mycket i de orden.

Ändå är jag inte helt övertygad. Visst skapade den flytande kronan förutsättningar för Riksbanken att bekämpa inflationen. Men samtidigt har tillväxten förblivit svag, massarbetslösheten är sjukskriven och genom åren har värdet på kronan nått nya bottennivåer.

Inte heller lyckades Riksbanken, eller någon annan centralbank i världen, förhindra uppkomsten av 1900-talets värsta tillgångsbubbla. Idel framgångar? Låginflationsmiljön lade grunden för optimismen, men botade inte våra ekonomiska problem. Kanske framkallade den till och med några, som kommer att visa sig när börsbubblan pyst färdigt.

Krisen kommer, var så säker. Det har den alltid gjort.

SURVEY: THE WORLD ECONOMY

The

unfinished recession

Sep 26th 2002

The Economist print

edition

IMF warns US economy could slow

BBC, 5

August, 2002

The comments were made in the IMF's annual review of the world's richest economy.

Investors have become increasingly concerned that the US economy could be heading for a double-dip recession, where apparent recovery gives way to another slowdown. The report, which will be published in late September, contains the Fund's next round of global forecasts.

Livet efter baksmällan

Den

nya ekonomin var inte nyare än den gamla

DN-ledare

2002-07-26

Börsrasen världen över är en reaktion på 90-talets aktieutveckling. Den nya ekonomin var inte nyare än den gamla. Och den gamla ekonomins lagar gäller än. Mitt i den värsta börsnedgången på många decennier letar investerare och allmänhet förtvivlat efter ljuspunkter. De är svåra att finna, även om Stockholmsbörsen återhämtade sig något i går efter de senaste veckornas kraftiga kursfall.

Det vi nu ser är i allt väsentligt inte en reaktion på avslöjanden om företagsskandaler, utan en dramatisk korrigering av 90-talets stigande aktiekurser. Jämfört med historiska värden - vinster, försäljningar, utdelning - nådde aktiemarknaderna i Europa och USA orimliga nivåer under det senaste decenniets guldår. Till slut blev en justering nedåt oundviklig.

Med rätta ogillar ekonomer att tala om bubblor. Marknader beter sig ofta effektivt och rationellt. Men den här gången finns det knappast ett bättre ord för att beskriva fenomenet. Det är lätt att vara efterklok, men varningar existerade under resans gång.

Mellan 1991 och 1999 var utvecklingen av Dow Jones-index närmast identisk med kursuppgångarna i USA på 20-talet och Japan på 80-talet. En bubbla ser aldrig likadan ut men hänger ofta samman med ett teknologiskt skifte, en kraftig ökning av billiga krediter och psykologiskt flockbeteende.

I 20-talets USA var det elektriciteten som fick snurr på ekonomin, i 80-talets Japan stod elektroniken för boomen och nu senast var det Internet och telekom som påstods ha skapat en "ny ekonomi". Med några års perspektiv framstår optimismen under den senare delen av 90-talet inte bara som starkt överdriven, utan närmast vild.

Talet om en "ny ekonomi" ledde tankarna fel. I själva verket befinner ekonomin i en ständigt pågående förändring. Ekonomin var ny såväl när textilfabrikerna såg dagens ljus på 1800-talet som när bilar började tillverkas på löpande band under 1900-talet. Och den är inte densamma i dag, när det finns datorer och Internet i vart och vartannat hem, som för 20 år sedan. Men minnet är kort. Och frestelsen att tjäna pengar stor.

Samtidigt tycktes den amerikanske centralbankschefen Alan Greenspan klara av att styra ekonomin bort från recession utan att inflationen tog fart från historiskt låga nivåer. Det stärkte optimismen. Till detta ska läggas starten för den folkliga kapitalismen, där allt fler vanliga människor stoppade in sitt sparkapital i en aktiemarknad som lovade hög avkastning och låg risk. USA:s och Europas åldrande befolkning invaggades i tron att börsen kunde skapa rikedomar åt alla, att pensionen skulle tryggas utan större uppoffringar. Så blev det inte.

Det finns anledning till djup självkritik bland förvaltare, politiker, medier och andra som generöst delat med sig av tvivelaktiga aktietips. Många bär ett ansvar.

Några "experter" säger nu att aktiemarknaden blivit billig. De riskerar att få fel igen. Mätt med flera traditionella analysverktyg är börsen långt ifrån lågt värderad, vilket bland andra Martin Wolf konstaterat i Financial Times.

Mycket talar också för att tidigare års rapporterade vinster varit överdrivna. Det ökar riskpremien och sänker kurserna ytterligare. Hur många miljarder har slösats bort på företag och projekt som inte varit produktiva? Ingen vet, men det rör sig om gigantiska belopp.

Dotcomkraschen gav en föraning om omfattningen. Telekomkraschen visade att det är värre än vad pessimisterna trott. När Ericssons styrelseordförande Michael Treschow nu skyller branschens problem på auktionerna av 3G-licenser gör han det mycket enkelt för sig. Telekomkrisen beror inte på några miljardauktioner år 2000, utan på orealistiska antaganden om tillväxten i Internettrafik. Här fanns motivet för de massiva investeringarna i fiberoptiska nätverk som resulterade i överkapacitet och enorma skulder.

Oron uppstår inte i ett tomrum

SvD-ledare 2002-07-26

Det går upp och det går ner. Men jämfört med toppnoteringen den 6 mars 2000 har kurserna på Stockholmsbörsen rasat med drygt 60 procent, enligt totalindexet AFGX. Analytiker talar om "fritt fall".

RE: Jfr Mats Johansson i högerspalt på ledarsidan i SvD 2000-04-16:

“Det är ingen större dramatik i det att börsen ibland korrigerar sig. Det gör marknader.”

Börsoron uppstår inte i ett tomrum. Det finns skäl att betrakta regeringens blomstermålningar med misstro. Vid en konjunkturnedgång riskerar Europa att drabbas hårdare än USA. Det vet vi av erfarenheterna från den mexikanska krisen, Asienkrisen och IT-kraschen. Europas allmäntillstånd är sämre än USA:s. Vår arbetslöshet är högre redan i utgångsläget, och tillväxten lägre.

En regering har begränsade möjligheter att uträtta något positivt i detta läge. Skattesänkningar kan ha en stimulerande effekt. Med tanke på hur socialdemokraterna låter de offentliga utgifterna skena iväg är det dessvärre snarast skattehöjningar som kan förväntas för Sveriges vidkommande, om vi fortsätter på den inslagna kursen.

Det finns emellertid ljuspunkter, exempelvis den oväntat starka amerikanska konjunkturutvecklingen. Vi kan hoppas på det bästa, men vi bör ändå räkna med dåliga tider.

Och glöm inte att nedgången kom under statsminister Göran Perssons vaktpass. Han valde att låtsas som om ingenting hade hänt.

Vad är nytt i den nya ekonomin

Nils-Eric Sandberg, VI-Direkt nr 7, november 2001

Den viktiga noderade förändringen under nittiotalet är att inflationen försvunnit... På nittiotalet kom den nya kombinationen av hög tillväxt och låg inflation. Detta är något som industrivärlden inte upplevt sedan andra hälften av tjugotalet.

RE: Sista året på tjugotalet var 1929

En hög inflationstakt skymmer förändringarna i relativpriserna. När inflationstalten går ned fungerar signalstystemet bättre.

Häri ligger, tror jag, det viktiga i den nya ekonomin.

Bo

Lundgren i Torsdagsbrev nr 21/2001, 11 oktober 2001:

Vad gäller

ekonomin lade Reagans marknadsliberala politik grunden för en

uppgångsfas utan motsvarighet i amerikansk historia. Fram till idag har

USA, med undantag för två kvartal under krisåret 1991,

fått uppleva 17 år av oavbruten mycket stark tillväxt.

Mediocre, not miraculous /US

economy/

Financial Times editorial, 2001-11-01

The longest economic expansion in US history is over. It lasted almost 10½ years - two years longer than the previous record upswing in the 1960s.

This cycle has been hailed as a miracle, the dawn of a new economy. The truth is much more mundane.

The good news should come first. At 3.1 per cent, the potential size of the US economy doubles every 23 years, not at all bad for a mature industrial economy.

But US growth rates are flattered by population growth.

Per capita economic growth is about one percentage point lower than the headline figure.

Historically, the latest cycle was by no means exceptional. The 1990s growth rate only just exceeded the lacklustre late 1970s.

In the economic cycle between 1973 and 1980, the US notched up average growth of 2.9 per cent.

Another common explanation is that only the late 1990s were different. Then, a step change in productivity growth raised the speed limit of the US economy. This argument has an element of truth.

Greater efficiency might allow the US economy to grow faster, perhaps by half a percentage point a year.

But that assumption has yet to be tested in an economic downturn.

Just as plausible is the suggestion that an unsustainable private spending and investment binge created the productivity improvement.

As the painful unravelling process gets under way, productivity growth could be shown to be more mirage than miracle. And a long period of stagnation, or even a deep recession, would then follow.

Se även:

Klas

Eklund på SvD:s ledarsida 2000-08-11:

För 20 år sedan

inledde Ronald Reagan en våg av skattesänkningar i

västvärlden. När USA sänkte sina skatter skärptes

trycket på andra att följa efter. Under en period blundade

många i Europa och en rad ekonomer (däribland jag själv)

hävdade att Reaganomics var ett oansvarigt tänkande. Men vi hade

fel. USA har ryckt åt sig ett stort försprång och har

världens mest framgångsrika ekonomi.

Bo

Lundgren i Torsdagsbrev nr 21/2001, 11 oktober 2001:

Vad gäller

ekonomin lade Reagans marknadsliberala politik grunden för en

uppgångsfas utan motsvarighet i amerikansk historia. Fram till idag har

USA, med undantag för två kvartal under krisåret 1991,

fått uppleva 17 år av oavbruten mycket stark tillväxt.

Felet med

Mosesteorin

SvD-ledare 2000-03-02

EU-kommissionen har under Romano

Prodis ledning förstått att studera vilka lärdomar Europas

beslutsfattare bör dra av den amerikanska modellen och dess väldiga

framgångar. Det var på tiden. Efter decennier av skleros och

Delorium har EU mycket att lära av den ekonomiska förnyelsen i USA,

som tog sin början under Reagan-åren.

/Göran/ Perssons ekonomiska filosofi samman fattas numera i sentensen om sju feta år, följda av sju magra, den s k Mosesteorin. Den stämmer inte på USA, som har upplevt en ekonomisk framgång av historiska mått över de senaste decennierna.

/Vi kan/ vända blicken bort från den amerikanska modellen och till siste arbetslös hålla fast vid alla de gamla krusbärsdogmerna. Då har vi inget att lära av det ekonomiska språnget i väster.

Mats Johansson: "Aldrig bättre att ha haft

fel"

Det är aldrig bättre att ha haft fel än att ha haft

rätt. (SvD 2000-08-17)

Nya ekonomin och bakmaskinen

Chefredaktören

Veckans Affärer nr 43/2001

Nu kommer uppgifter om att den så upphaussade IT-eran mellan 1995 och 2000 inte bara var en börsbubbla. Även själva grundvalen för spekulationen - talet om en ny ekonomi, där IT och internet var motorn för ekonomisk tillväxt - skjuts nu i sank av den internationella konsultfirman McKinsey.

“Det har aldrig funnits en ny ekonomi, i det avseende som vi kom att prata om det”, konstaterar McKinsey, efter att ha gjort en omfattande analys av den amerikanska ekonomin de aktuella åren.

Trist läsning för alla dem som rycktes med i snacket om en ny ekonomi, där de gamla reglerna satts ur spel. Och det var många. Inte bara popikoner som Birgersson, Carlzon och Sturmark, utan också stora delar av etablissemanget: Finansanalytiker, konjunkturbedömare, institutioner som Svenskt Näringsliv och, inte minst, media.

Alla ivrigt påhejade av IT-industrin, som såg en chans att få sälja ännu mera. Även Fed-chefen Alan Greenspan var ett tag inne på att det kanske trots allt skett en fundamental förändring i det ekonomiska systemet.

Men så var inte fallet, hävdar alltså nu McKinsey. Det går inte att påvisa några tydliga samband mellan investeringar i IT, ökad produktivitet och därmed ekonomisk tillväxt.

Av 59 undersökta branscher svarade sex för hela 99 procent av produktivitetsökningen i amerikansk ekonomi - grossist- och detaljhandeln, telekom, data- och elektronik samt värdepappershandeln. Och i de fall man kunnat spåra en viss koppling, har IT ändå bara varit en av flera drivkrafter. Inom detaljhandeln spelade innovation och konkurrens en betydligt större roll än något annan faktor. I andra branscher sjönk t o m tillväxttakten, trots ökade IT-satsningar.

Numera är det också få som pratar om en ny ekonomi. Hösten 2001 känns begreppet lika trendigt och fräscht som årets julklapp 1988: bakmaskinen

Bo Lundgren i Torsdagsbrev nr 21/2001,

11 oktober 2001

Vad gäller ekonomin lade Reagans marknadsliberala

politik grunden för en uppgångsfas utan motsvarighet i amerikansk

historia.

Bankers sound hard-landing alert for US

economy

Financial Times; Jun 12, 2001 By ALAN BEATTIE

The US economy is at riskof a hard landing unless growth picks up elsewhere in the world, the Bank for International Settlements said yesterday.

Imbalances in the US economy - the huge current account deficit, high private debt and low savings ratio - would have to be redressed, according to the annual report of the body, the central banks' central bank.

Andrew Crockett, the bank's general manager, said a prolonged U-shape downturn rather than a sharp V-shaped recovery was most likely.

He said a rise in economic growth in the rest of the world and a gradual depreciation of the dollar would enable the US to make a smoother, though more prolonged, transition to stability. "But if these things do not happen, the risk remains of more disruption, and that is something we have always warned about."

The BIS said larger and more liquid financial markets had allowed the US to live beyond its means longer than in the past. Greater financial sophistication meant there was "more scope for disruptive adjustments as well as more productive use of capital", Mr Crockett said.

The bank's annual report also suggested that the US Federal Reserve had less room to cut interest rates than hitherto, citing signs of incipient inflationary pressure such as the increase in long-term US interest rates since March.

Market power

Financial Times Editorial Jun 12, 2001

Do the financial markets serve the world economy - or is global prosperity at the mercy of the capital markets? The Bank for International Settlement's annual report looks at the linkages between the financial markets and the real economy, a relationship that is rightly receiving increased attention.

Changes in credit conditions and asset prices have long played a part in economic cycles. By their nature, they are pro-cyclical.

During an upswing, when growth expectations are high, a virtuous circle is created. Asset prices rise, spurring spending and encouraging lending on rising collateral values; this additional spending feeds back into even higher asset prices.

This process may be accelerated if there is a genuine reason to believe that growth prospects have been improved, such as economic liberalisation in the 1980s or the technology revolution of the late 1990s.

This virtuous circle invariably turns vicious in a downturn. If financial markets do not trigger a turn in the economic cycle, at the very least they amplify it.

Worse, the markets overshoot. For a range of reasons, many of them psychological, optimism about growth is exaggerated in an upswing, making the downturn worse when it comes.

The interesting question is whether this effect is getting greater over time. Financial liberalisation and the increase in global capital flows certainly make the world more vulnerable to credit and asset price cycles. The contagion effect of the Asian financial crisis was an example.

There is one other factor that the BIS believes has been an important influence on the latest global economic cycle. Paradoxically, it argues, monetary stability - the control of inflation - may have fed financial instability by creating an expectation that nothing could go wrong.

The US in the late 1990s, for instance, seemed to have achieved the Holy Grail of high growth, low unemployment and low inflation. In many emerging markets, good monetary and fiscal policy was taken by investors as a guarantee of future growth.

In both cases, it was forgotten that while low inflation is a necessary condition for economic stability, it is not a sufficient one. Financial imbalances, such as excessive credit growth, have just as much chance of derailing an economy as price instability.

There is a tried and tested method for inflation control by way of interest rate management. But preventing credit booms and asset price bubbles is a far harder, if not an impossible, task. Even if there is greater vigilance, the financial cycle remains a threat to global economic stability.

Miracle or mirage

Gerard Baker, Financial

Times, June 8 2001

New-economy icons have been falling for months in the US, like revolutionary statues after a coup. The rubble from billion-dollar dotcoms, million-dollar apartments and thousand-dollar suits continues to pile up in the streets as the business cycle reasserts its tyranny over those who thought they had liberated themselves from the laws of economics.

But while the iconography of excess is steadily dismantled, so far at least, Americans' faith in the fundamentals of the revolution itself remains oddly robust. Equity prices still assume that high-technology-driven improvements in productivity will keep up the accelerated pace of profits growth for years to come.

CNN 2001-06-05

U.S. workers were far less

productive in the first quarter than originally thought, the government said

Tuesday, the first quarter in six years worker productivity has fallen.

Productivity, a measure of worker output per hour, fell at a revised 1.2

percent annual rate in the quarter, the Labor Department said, much more than

Wall Street forecasts for a negative 0.7-percent rate and below the fourth

quarter's revised 2 percent rate of growth.

The Economist

2001-05-10

The announcement on May 8th that America's productivity

declined in the first quarter of 2001 at an annual rate of 0.1%, compared with

growth of more than 5% during the year to June 2000, is a blow for the

IT-powered new economy. One by one, its claims to be special are being exposed

as myths. Now it seems that the widely-held belief that America's sustainable

rate of productivity growth had doubled to around 3% was also mere myth. That

does not mean, however, that the new economy was entirely hot air.

The Economist:

Don’t say “new economy”2001-01-04

Wall Street fears

that America’s economic slowdown may turn vicious. So, apparently, does

Alan Greenspan, who cut interest rates unexpectedly this week. Is it all over

for the new economy?

Web Economy Bullshit Generator

Greenspan Sees Productivity Continuing Despite Slowdown in

Economic Growth

Wall Street Journal, April 27, 2001

The remarkable improvement in productivity in recent years is likely to continue despite the slowdown in the economy, Federal Reserve Chairman Alan Greenspan said Friday.

There likely will be some moderation in productivity growth because of the weaker economy, but the lull should be only temporary, Mr. Greenspan said.

Productivity -- the amount of output per hour of work -- is the key ingredient determining Americans' living standards. The significant pickup in productivity growth that has occurred since 1995 has been a major factor supporting the record-long economic expansion.

In a speech delivered by satellite to a bond-traders convention in West Virginia, Mr. Greenspan indicated that he has not lost faith in the belief that massive investments in computers and other high-tech equipment in recent years has permanently improved the outlook for productivity.

Such a development is especially important to the record government budget surpluses, Mr. Greenspan said.

"The dramatic improvement in projections of the budget balance in recent years reflects, in large part, the pickup in underlying productivity growth in the U.S. economy, which has boosted corporate profits and household incomes and thereby tax receipts," Mr. Greenspan said.

Mr. Greenspan noted that projections by congressional and White House economists that the surplus will total $5.6 trillion over the next decade are based on a belief that the upturn in productivity seen since 1995 will continue.

Mr. Greenspan said he agreed with this assessment even though the measured rate of productivity will slow somewhat as the economy cools.

For the two decades from 1973 to 1995, productivity averaged lackluster gains of just more than 1% per year. However, since 1995 increases have more than doubled, allowing companies to pay workers higher salaries without raising prices.

Mr. Greenspan also expressed confidence in the ability of U.S. financial markets to adapt to the growing scarcity of Treasury securities as the federal debt of more than $3 trillion is paid down. He said the loss of Treasury securities as benchmarks for the bond market "seems unlikely to result in major difficulties for market participants because alternative benchmarks are easy to envision."

"Of course, the resulting adjustments will not be perfect and, in some cases, will impose costs on financial market participants," he said. "However, I believe that these costs are very likely to be outweighed by the benefits to the country of a higher capital stock and the resulting increases in productivity and income that appear to be the consequence of debt reduction."

He repeated past comments that the U.S. government should continue to pay off its debt, while cautioning that the total elimination of Treasury securities would cause difficulties not only for domestic and foreign investors but for the U.S. central bank, as well.

Det blir ingen mjuklandning

DN-ledare 2001-03-14

I backspegeln verkar det envisa fasthållandet vid ett mera optimistiskt perspektiv därför nästan lite naivt.

Men de flesta prognosmakare, börsmäklare och andra ekonomiska analytiker har varit lika goda kålsupare.

Man har talat om en tillfällig avmattning, en "mjuklandning" för ekonomin eller en "normalisering". Vad som ökat oemottagligheten för negativa signaler är förmodligen att den senaste högkonjunkturen har varit onormalt lång, nästan åtta år.

Om SvD och Moses

Rolf

Englund på internet 2001-03-14

Martin Wolf, A testing year for the

world

Financial Times, January 3, 2001-01-03

The second test is of

the “new economy”. Not long ago, believers thought that the business

cycle was dead, profits were irrelevant to technology companies and the US was

in the middle of an unparalleled technological revolution.

The lure of the American

way

Martin Wolf, Financial Times, Novbember 1, 2000

Europe’s stony ground for the seeds of growth:

Continental nations must cast off corporatism if they are to emulate

thriving economies

Edmund

Phelps, Financial Times, 09-Aug-2000

Understanding the Recent Behavior of U.S. Inflation

by

Robert W. Rich and Donald Rissmiller

Federal Reserve Bank of New

York, July 2000 Volume 6, Number 8

One of the most surprising features of the long current expansion has been the decline in price inflation through the late 1990s. Some observers interpret the decline as evidence of a permanent change in the relationship between inflation and economic growth. But an analysis based on a standard forecasting model suggests that conventional economic factors - most notably, a decrease in import prices - can account for the low inflation rates in recent years.

http://www.ny.frb.org/rmaghome/curr_iss/ci6-8.html

Remarks by Chairman Alan Greenspan Structural change in the new

economy July 11, 2000

"Until we experience an economic slowdown, we

will not know for sure how much of the extraordinary rise in output per hour in

the past five years is attributable to the irreversible way value is created,

and how much reflects endeavors on the part of our business community to

stretch existing capital and labor resources in ways that are not sustainable

over the long run."

Hela talet på http://www.bog.frb.fed.us/BoardDocs/Speeches/2000/20000711.htm

Felet med Mosesteorin, SvD-ledare 2000-03-02, utdrag

Jfr Economist 2000-06-10: Another miracle Is America’s economy really slowing?

Du sköna nya ekonomi

DN-ledare 2000-06-09

Låg ränta trots

högkonjunktur

Klas Eklund på SvD:s ledarsida 2000-06-06

Standard & Poor's Corp. cut its credit rating on General Motors (GM, news, msgs) to B from BB- today.

"This year has witnessed a stunning collapse of GM's financial performance," Robert Schultz, an S&P credit analyst, said.

CNBC 12/12 2005

S&P is pessimistic that GM's recovery plan will work, the agency said, and the auto giant may have to seek more drastic measures, namely Chapter 11. Schultz said the agency estimated that G.M. could lose $5 billion in North America and post a $3 billion corporate net loss for 2005.

New figures coming out of the US economy confirms that in almost every respect

it is doing significantly better than expected. It is impressive.

Carl Bildt blog 6/12 2005

With the right policies and the right funding we would both be able to use

our larger and richer talent pool and be better able to attract the best and the brightest

from around the world.

Over time, there is little doubt that this would translate into a more globally competitive knowledge economy in Europe.

And then we could see the European economy starting to grow at the least as impressively as the American one is doing at the present.

We must overtake and outstrip the advanced technology of the developed capitalist countries.

Cit. from the speech given by Stalin to the party Central Committee in Nov. 1928.

Mer om Bildt, Stalin och Lissabon

Dollar low against the euro for the fourth day in a row

- touched 1.5239

BBC 29/2 2008

The US dollar also sank against other currencies, tumbling to almost three-year lows against the Japanese yen.

For the first time, a dollar now buys less than 105 yen.

The British pound also hit a record low against the euro of 76.54 pence.

Under the placid surface, there are disturbing trends: huge imbalances, disequilibria, risks - call them what you will. Altogether the circumstances seem to me as dangerous and intractable as any I can remember, and I can remember quite a lot.

What really concerns me is that there seems to be so little willingness or capacity to do much about it.

Paul A. Volcker, Washington Post, April 10, 2005

Ur Carl Bildts veckobrev v14/2000

IMF justerar i dag upp sin tillväxtprognos och talar nu om en global tillväxt detta år på cirka 4,2 procent. Det drivs av den rekordstarka USA-ekonomin på runt 4,3 procent, medan EU kommer ungefär en tredjedel efter på cirka 3,2 procent.

Det är imponerande siffror. Att den amerikanska ekonomin fortsätter att ånga på i rekordfart trots inte mindre än fem räntehöjningar - även om effekten av sådana alltid kommer med fördröjning - visar åter styrkan i den omvandling som skett där.

Och för EU, som satt upp målet att inom detta decennium bli världens mest konkurrenskraftiga ekonomi, innebär detta att ribban ligger högre än vad de flesta sannolikt har klart för sig.

Och det gäller också Sverige. Under ett kvarts sekel har vi halkat efter i förhållande till andra utvecklade länder. Nu är uppgiften inte bara att se till att det går väsentligt bättre under en längre tidsperiod, utan att se till att det går radikalt mycket bättre.

Om EU skall bli bättre än USA, och Sverige inom detta EU skall röra sig upp i listan, handlar det om att skapa förutsättningarna för en turboutveckling av Sverige.

Vem vet?

Ledare Finanstidningen 2000-04-03

Så kom en korrigering. Har bubblan brustit nu? Eller finns det mer luft som ska pysa ut? Eller är det kanske ingen bubbla?

Sådana här dagar är nog de flesta ekonomiskribenter glada att läsarnas minne ofta är kort. Att analysera "den nya ekonomins" framtidsutsikter är inte något som låter sig göras med en känsla av tvärsäkerhet. Man kan använda samma strategi som den stillastående klockan: håll fast vid exakt samma prognos: det kommer att gå ned, det kommer att gå ned, det kommer att gå ned. Förr eller senare blir det sant. Men man har trots allt begränsad nytta av en klocka som står.

Vi vet inte om en hel del av de riktmärken som tidigare gjorde det möjligt att känna viss säkerhet i siandet inte längre gäller.

Men om så inte är fallet, om den gamla kartan i allt väsentligt ännu gäller, är omvärlden ändå full av tillfälliga avvikelser som rör till det. USA:s enastående långa högkonjunktur. Alan Greenspans närmast mytiska förmåga. Euron. IT-utvecklingen och dess betydelse - eller, skulle vissa säga, överskattade betydelse. De friare kapitalrörelserna. En (stabil?) låginflationspolitik. Och så vidare.

Ingen vet egentligen vad som pågår i vår ekonomiska samtid.

Lite tillspetsat är det så.

Inte ens de som ska vägleda oss. De har teorier - i många fall flera. De kan tycka att vissa gissningar verkar bättre än andra - åtminstone denna vecka.

Men de vet inte vad som pågår. Ena dagen är den långa boomen den allmänt omfattade storyn. Andra dagen är den omedelbart förestående kollapsen det som gäller.

Det är inte så mycket att göra åt det. Det beror inte på inkompetens. Det beror inte på att de som är satta att ge ledning är för lata för att göra sitt jobb. Det beror på att framtiden är genuint oförutsägbar. Vi kan inte veta. Det enda vi kan göra är att extrapolera - dra dagens trender framåt - och justera med hjälp av diverse påhänga hypoteser, baserade på teori eller erfarenhet. När dagens trender verkar ohållbara och värdet av tidigare erfarenhet, och en hel del teorier, ifrågasätts, finns inte mycket att arbeta med.

Wealth effect

From Financial Times leader

2000-03-08

Does Alan Greenspan chairman of the Federal Reserve, really think that a faster rate of productivity growth is a bad thing? The answer is, of course not. But Mr Greenspan is concerned that good news about more efficient production tomorrow could affect domestic demand today. And excessive demand is the Fed chairman's big headache.

Higher productivity growth raises the economy's long-term growth rate. And it allows wages to grow faster without setting off inflation. In the US non-financial corporate sector, output per head has increased at a 3.5 per cent annual rate in the past five years, double the rate in the preceding 20 years.

Mr Greenspan, in his speech this week in Boston and in recent testimony before Congress, basked in the remarkable perfor mance of the US economy, due in large part to the information technology revolution.

But, while the economy has grown at an annual average rate of 3.9 per cent over the past five years, real domestic demand has grown at a 5 per cent rate.

Mr Greenspan has suggested that expectations that the high rate of productivity growth of the past few years will be maintained may contribute in the short term to the underlying problem of excessive domestic demand.

The link is via a shift in expectations about future corporate earnings, and a rising stock market. This spurs business investment, which increases the economy's capacity to supply. But it also contributes to consumer demand. As stock market wealth rises relative to household income, consumers spend more.

Mr Greenspan points to evidence that 3-4 per cent of stock market gains are reflected in higher household spending.

There is a timing mismatch. The goods and services have not yet been produced to meet the increased purchasing power.

The result, so far, has been a rising current account deficit and a shrinking pool of labour.

To restore equilibrium in both the product and financial markets, long-term interest rates must go up and the stock market must stop rising faster than household income.

The Present U.S.

Expansion Outshines The 1960s Expansion

By John H. Makin, American

Enterprise Institute, Economic Outlook February 2000

The policies of the

Reagan administration - ending the Cold War, deregulation, free trade, and

falling inflation - reinforced by those of the Bush administration -

successfully quelling the threat to global peace from rogue states in the Gulf

War and placing a durable cap on government spending growth with the 1990

budget agreement - contributed far more to the emergence of a golden age in the

1990s than did Clintonomics.

By John H. Makin, American Enterprise

Institute, Economic Outlook February 2000

Boom Boom: '90s Beat the '80s

By Martin N. Baily, chairman of the president's Council of Economic

Advisers.

Wall Street Journal 2000-02-25

För mina inlägg genom åren på Nationalekonomiska Föreningen kan Du klicka här.