Finanskrisen 2007 -

Oscar Properties aktie faller handlöst på börsen – aktien handlas ner 19 procent.

Johan Hellekant SvD 18 februari 2019

Fed had lost its way.

From bubble to bubble, from crisis to crisis, there were increasingly compelling reasons to question the Fed’s stewardship of the US economy

That now appears to be changing.

STEPHEN S. ROACH Project Syndicate Dec 24, 2018

The U.S. Treasury Department raised eyebrows

and jogged worrying memories of the financial crisis Sunday with a statement that

Secretary Steve Mnuchin convened calls with the CEOs of six leading banks to confirm they had ample liquidity,

in hopes of averting another Wall Street selloff Monday.

24 december 2018

The legacy of the great crash of 2008 — economic, financial and political — hangs heavy in the air:

banks bailed out to the tune of £500bn; the bankers responsible punished only in the court of public opinion;

the imbalance between risk and sky-high rewards barely addressed by boards and shareholders.

FT editor Lionel Barber 23 November 2018

Full text

Top of page

It was not Lehman itself that held together the global financial system,

but an implied guarantee that said “Global banks cannot be allowed to fail”.

Frances Coppola - September 15, 2018

The moral of the story is that if only we economists had spoken up sooner, been more convincing on the issues where we were right, and recognized where we were wrong,

the situation today would be considerably better.

J. Bradford DeLong Project Syndicate 1 November 2018

In 2008, Republicans rallied behind the late Senator John McCain’s running mate, Sarah Palin, a folksy demagogue who was even less suited for office than Bush or Cheney;

and in 2010, the party was essentially hijacked by the populist Tea Party.

Full text

Top of page

How to avoid the next financial crisis

The financial crisis of 2008-09 and the resulting recession were a historical watershed.

The pre-crisis world was one of globalisation, belief in markets and confident democracies.

Today’s is a mirror image.

Martin Wolf 9 October 2018

Full text

Top of page

Finance, the media and a catastrophic breakdown in trust

Two days after Lehman Brothers declared bankruptcy, in September 2008, I went on an anxious walk to my local bank branch.

Working in New York, I had recently sold my flat in London and a large sum had just landed in my account at Citibank

— far more than the insured limit, which at that point was $100,000.

John Authers FT 4 October 2018

Full text

Lehman Brothers

The 2008 financial crisis was not the result only of moral hazard; nor was it unforeseeable.

NICOLA GENNAIOLI , ANDREI SHLEIFER Project Syndicate Sep 27, 2018

While too-big-to-fail banks believed – rightly, it turned out – that they would be bailed out, consumers, rating agencies, and policymakers all bet on housing as well, destabilizing the system.

As we describe in our new book, A Crisis of Beliefs: Investor Psychology and Financial Fragility, the fundamental cause of the crisis was the deflation of the housing bubble, starting in early 2007.

Full text

Top of page

VIP

Too many suffered too much for too long, while those responsible avoided justice.

A Template For Understanding Big Debt Crises, by Ray Dalio, Bridgewater, 471 pages

Ray Dalio, founder of the world’s largest hedge fund Bridgewater

As Dalio would have predicted, problems were harshest in economies that do not control the currency in which they borrow

— where the crisis dragged on the longest and created the greatest economic pain.

As for the solution, he is gloriously laconic: “In the end, policymakers always print.”

John Authers FT 21 September 2018

Full text

Om man har en sedelpress går man inte i konkurs

Englund blog 4 november 2011

Steve Eisman blev världsberömd efter att en karaktär baserad på honom blev huvudrollen i filmen “Big Short”.

– Nu vill alla att jag ska berätta vad som blir nästa krasch, säger han till DN på tioårsdagen av finanskraschen.

DN 14/9 2018

Full text

...

“Amazing” that the Irish government has “socialized” the banks

— some $80 billion in senior and subordinated debt — and made it the financial responsibility of Irish taxpayers, who didn’t create it.

Michael Lewis, author of "Liar’s Poker," "The Big Short" and "The Blind Side,"

CNBC 1 Feb 2011

”Beredskapen inför nästa finanskris inte särskilt hög”

Klas Eklund DN Debatt 14/9 2018

Full text

That entire Armeggedon scenario was a fiction arising from what we have called the Blackberry Panic, which broke out when Hank Paulson and his posse of Wall Street sharpies at the US Treasury Department saw Goldman's stock plunging hour after hour and concluded that the entire financial system was imploding into a black hole.

David Stockman 12 September 2018

The fundamental question is why economic growth has become so debt dependent

Adair Turner 9/11 2018

Rising inequality is probably one answer, with poorer people trying to use debt to compensate for stagnant real wages. The increasing role of real estate in modern economies is also crucial.

The priority is to understand these and other causes and to design an appropriate policy response. By contrast, worrying about a repeat of 2008 is planning for the last war.

Full text

Leverage

More by Adair Turner

Top of page

We May Be Facing a Textbook Emerging-Market Crisis

Argentina and Turkey look like outliers but the rot could spread fast.

Satyajit Das Bloomberg 3 september 2018

Full text

More by Satyajit Das at IntCom

The world has not learned the lessons of the financial crisis

Banks are safer, but too much of what has gone wrong since 2008 could happen again

The Economist editorial 6 September 2018

Systemic banking meltdowns are a feature of human history.

The state had no choice but to stand behind failing banks, but it took the ill-judged decision to all but abandon insolvent households.

Perhaps 9m Americans lost their homes in the recession;

Full text

Banks

cnbc.com/2018/09/10/the-financial-system-still-looks-vulnerable-despite-post-lehman-banking-rules-experts-say

cnbc.com/2018/09/07/bob-pisani-lessons-i-learned-watching-the-financial-crisis-unfold-from-a-front-row-seat-at-nyse.html

Why so little has changed since the financial crash

Martin Wolf FT 4 september 2018

If those who believe in the market economy and liberal democracy do not come up with superior policies, demagogues will sweep them away.

A better version of the pre-2008 world will just not do. People do not want a better past; they want a better future.

Read more here

Martin Wolf at IntCom

Martin Wolf at FT

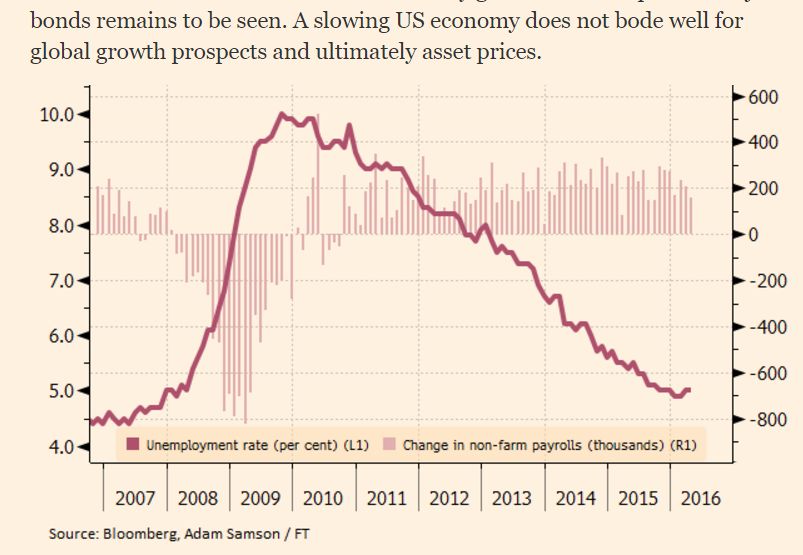

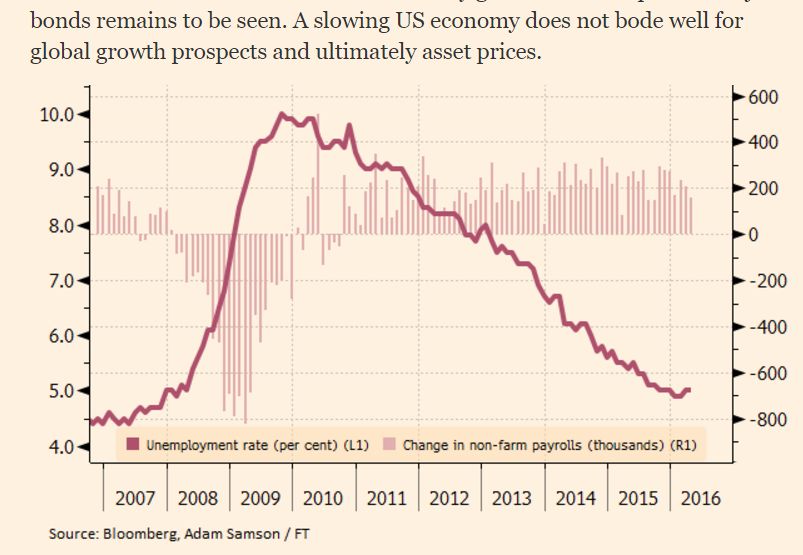

As the U.S. economy entered its worst downturn since the Great Depression,

Congress enacted legislation to increase discretionary spending to stimulate the economy.

St. Louis Fed 2018-08-24

New programs ranged from financial assistance for large banks and car manufacturers to tax rebates for low-income households and also included funding for public projects, such as highway construction.

At its peak, in early 2009, total discretionary spending was about $1.2 trillion in annual terms, or 7 percent of GDP.

Full text

J.P. Morgan's top quant Marko Kolanovic predicts a "Great Liquidity Crisis" will hit financial markets,

marked by flash crashes in stock prices and social unrest.

CNBC 4 September 2018

The trillion-dollar shift to passive investments, computerized trading strategies and electronic trading desks will exacerbate sudden, severe stock drops, Kolanovic said.

Central banks will be forced to make unprecedented moves, including direct purchases of equities or negative income taxes.

Timing of when this next crisis will occur is uncertain but markets appear to be safe through the first half of 2019, he said.

Full text

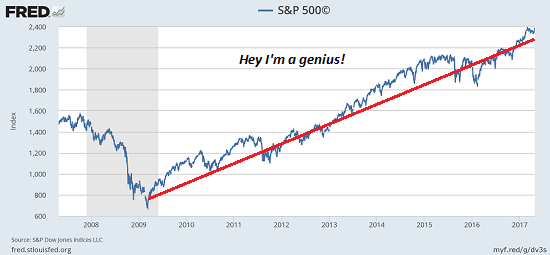

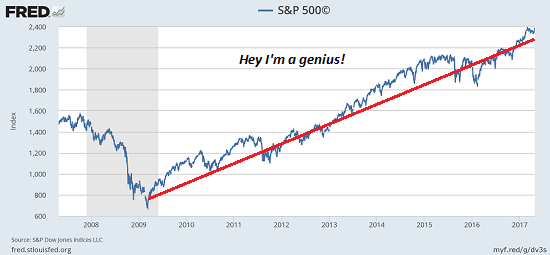

Investors who bought the day before Lehman failed are up 130%

CNBC 10 September 2018

A decade after the collapse of Lehman Brothers, J.P. Morgan takes a look back

at the response to the financial crisis that reshaped financial markets and the global economy.

JPM August ? 2018

Full text

Have we learnt the lessons of the financial crisis?

One day in the early summer of 2007, I received an email out of the blue from an erudite Japanese central banker called Hiroshi Nakaso.

“I am somewhat concerned,” he began

Gillian Tett FT 31 August 2018

One day in the early summer of 2007, I received an email out of the blue from an erudite Japanese central banker called Hiroshi Nakaso. “I am somewhat concerned,” he began in typically understated manner, before warning that a financial crisis was about to explode because of problems in the American mortgage and credit market.

I was astonished. That was not because I disagreed with Nakaso’s analysis: by June 2007, I had been writing about the credit sector for a couple of years as the FT’s capital markets editor in London, and was uneasy.

But I was surprised that it was Nakaso raising the alarm.

So why was Nakaso pessimistic? “Déjà vu”, he replied.

A decade earlier, back in 1997, Nakaso had been working at the Japanese Central Bank when Tokyo plunged into its terrible banking crisis, sparked by $1tn of bad loans left by Japan’s 1980s real estate baburu keiki, or bubble.

Full text

Japan

Gillian Tett at IntCom

Gillian Tett at FT

Argentina continues to suffer from deepening market panic.

FT 30 August 2018

Populism is the true legacy of the global financial crisis

The ‘hard working classes’ so beloved of politicians were the victims of the crash

Philip Stephens FT 30 August 2018

The Myth of Secular Stagnation

There are many lessons to be learned as we reflect on the 2008 crisis, but the most important is that the challenge was – and remains – political, not economic:

there is nothing that inherently prevents our economy from being run in a way that ensures full employment and shared prosperity.

Secular stagnation was just an excuse for flawed 8economic policies.

Joseph E. Stiglitz Project Syndicate 28 August 2018

The market value of the S&P 500 is up 312 per cent from March 9, 2009, $18.4tn.

FT 22 August 2018

Ten years after Lehman collapse few lessons have been heeded

Rating agencies still wield huge influence and investment executives remain unaccountable

To be clear, nobody expects economic models to predict crises, future prices and recessions with total accuracy.

But at least they should be able to explain the basic functioning of the economy.

Arturo Cifuentes FT 22 August 2018

Krasch, boom, bang – hur stor är risken för nästa finanskris

Artikelsamling SvD 2018

Den 15 september 2008 ansökte den amerikanske investmentbanken Lehman Brothers om konkurs.

Hur väl rustade är världens ekonomier idag? Var finns obalanserna som skulle kunna skapa nästa finanskris?

Och vad händer då?

Full text

Top of page

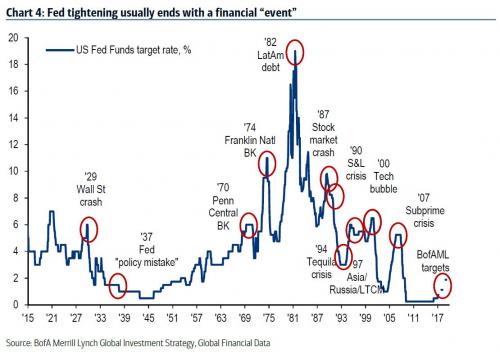

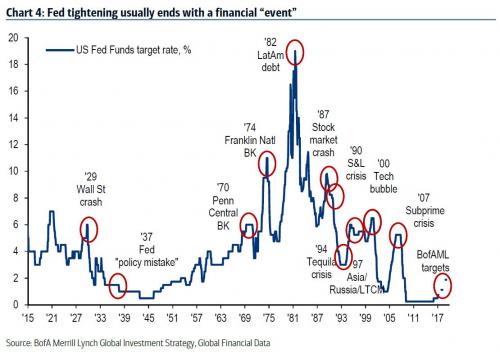

Not a credit crunch yet, but the ground is shifting

Short-term interest rates are the tectonic plates of financial markets.

They move slowly but have a nasty tendency to reveal buildings built on flimsy foundations.

Robin Wigglesworth 8 August 2018

Full text

...

Era of quantitative easing is drawing to a close

arguably the greatest monetary policy experiment since John Law began dabbling with fiat paper money in France

Robin Wigglesworth, FT 8 December 2016

The recurring theme: policymakers are in uncharted waters.

"I don't want to scare the public, but we've never had QE," Dimon said.

"We've never had the reversal. Regulations are different. Monetary transmission is different.

Governments have borrowed too much debt, and people can panic when things change."

Jamie Dimon is chairman and chief executive officer of J.P. Morgan Chase.

Full text

---

But as time goes on, and economic indicators show no sign of returning to their pre-crisis trends,

macroeconomists are beginning to realise that they are lost. In this new, strange world, their maps are wrong and their models useless.

They are flying blind.

Frances Coppola - October 12, 2017

GAM blocks fund redemptions

It is highly unusual for asset managers to block investors from redeeming their money.

FT 2 August 2018

Full text

Finanskrisen och därmed eurokrisen tog sin början i Frankrike,

när tre hedgefonder tillhöriga Frankrikes största bank,

BNP Paribas, inställde betalningarna i augusti 2007.

Läs mer här

Doom

If the western world has seen populism jump when economic times are good,

what on earth will happen when the next recession hits?

Gillian Tett FT 1 August 2018

Hussman sees Nasdaq sinking 57%, Dow tumbling 69%

Hussman’s claim to fame includes forecasting the market collapses of 2000 and 2007-2008.

Sue Chang MarketWatch July 31, 2018

November 2018 will mark the tenth anniversary of quantitative easing (QE)

— undoubtedly the boldest policy experiment in the modern history of central banking.

Stephen S. Roach 30 July 2018

How To Deal With Failed Banks

Resolving a failing bank should rely on bail-ins:

private stakeholders should bear the losses

IMF blog 3 July 2018

Top of page

Western businesses have slipped jobs overseas to countries with low labor costs,

while the middle class has been pushed into debt in order to try to keep up.

The Glass-Steagall law and other brakes on American banks were abolished by a cheerleader for globalization, Bill Clinton,

and these banks subsequently lost all restraints in their enthusiasm to lend.

The cherry on top of the sundae was the real estate bubble and ensuing crash of 2008

Enrico Verga via nakedcapitalism.com 20 July 2018

Full text

Skuldfrågan

European banks still have post-crisis repairs to do

Former US policymakers say their counterparts did not do enough to stop the rot

Gillian Tett FT 19 July 2018

Mr Powell’s testimony suggests he that he understands the risks if the signal from the yield curve proves accurate.

What some investors fear is that he may not act on them before it is too late.

FT 19 July 2018

The Debt Train Will Crash

“We no longer have business cycles, we have credit cycles.”

John Mauldin 13 July 2018

Trump’s Trade War May Spark a Chinese Debt Crisis

A tighter dollar will make the bursting of the credit bubble an inevitability

The whole economy is a Ponzi scheme.

Anne Stevenson-Yang Bloomberg 18 July 2018

Top of page

Ben Bernanke, Timothy Geithner and Henry Paulson all voiced varying degrees of concern

about America’s ability to combat another financial meltdown

10 years after they played prominent roles battling the last one.

Bloomberg 18 July 2018

Rapidly rising government debt.

“If we don’t act, that is the most certain fiscal or economic crisis we will have,” said Paulson,

who chairs his own institute in Chicago.

Full text

There was no deleveraging at all

---just more of the same;

and that the debt-based financial fragility that caused the system to literally meltdown in the fall of 2008

has merely metastized from $52 trillion to nearly $69 trillion.

David Stockman's Contra Corner 17 July 2018

Top of page

Mr Tooze sides with most economists in taking the view that the immediate post-crisis response was necessary,

but unfortunate in that executives in the banking industry paid too low a price for their folly;

that Europe was slow and narrow-minded in dealing with the peripheral countries;

and that the switch to austerity was a mistake.

The Economist 2 August 2018

Taken together, the backlash against bankers, frustration with EU governments and the impact of austerity led to the rise of populism, the election of Donald Trump and the Brexit vote.

Full text

What really went wrong in 2008?

"Even people who have followed this story closely will learn a great deal."

Crashed: How a Decade of Financial Crisis Changed the World, Book by Adam Tooze

Martin Wolf FT’s chief economics commentator 17 July 2018

Full text

Skuldfrågan

Top of page

France’s market watchdog is bracing for a surge in global bond yields and a Wall Street crash

as soon as this year, fearing that contagion will spread to Europe and snuff out the fragile recovery.

Ambrose Evans-Pritchard Telegraph 5 July 2018

There are important implications for investors if central banks are not the main cause of lower interest rates.

For one, it means that rates will probably remain low even after the ECB finishes its asset purchases.

Marc Chandler FT 27 June 2018

Banks may be disguising their borrowings

with debt ratios falling within limits imposed by regulators just four times a year.

Bloomberg 24 June 2018

Lenders use repurchase agreements -- known as repos -- to massage down their assets as reporting dates approach, typically as quarters end,

the Bank for International Settlements said in its Annual Economic Report.

Read more here

Chinese real estate is in bubble territory

From June 2015 through the end of last year, the 100 City Price Index rose 31 percent to nearly $202 per square foot.

That's 38 percent higher than the median price per square foot in the U.S., where per-capita income is more than 700 percent higher than in China.

Not surprisingly, this has put homeownership out of reach for most Chinese.

Bloomberg 24 June 2018

Why banks and regulators missed the risks in the credit system before 2008

Gillian Tett FT 20 June 2018

It’s not the big, obviously radical decisions that create disasters in finance but subtle periods of mission creep, when slightly deviant behaviour is quietly tolerated.

Red more here

Skuldfrågan/ Who is responsible?

Former U.S. Treasury Secretary Lawrence Summers:

“The consequences of another economic downturn dwarf and massively exceed

any adverse consequences associated with inflation pushing a bit above 2 percent,”

Summers said at a European Central Bank conference in Sintra, Portugal.

Bloomberg 18 June 2018

February’s market shock was just the canary in the coal mine

Low volatility leads investors and traders to adopt strategies that make the financial system more fragile and vulnerable to crisis.

John Plender FT 18 June 2018

Full text

Top of page

Post-crisis, financial regulators decided to nominate a select few GSifis

(global systemically important financial institutions).

From the market top on January 26 until May 31, they lost $800bn in market capital, or about 18 per cent.

John Authers FT 14 June 2018

The Global Debtberg — $ 238 Trillion And Counting

David Stockman's Contra Corner with nice chart

The entire world went into debt for the equivalent of tropical vacations and, having now enjoyed them, realizes it must pay the bill. The resources to do so do not yet exist.

So, in the time-honored tradition of lenders everywhere, we extend and pretend.

But with our ability to pretend almost gone, we’re heading to the Great Reset.

John Mauldin 8 June 2018

Top of page

RBS Government’s stake is worth around £24bn,

little more than half the £45bn of public money used to keep the bank afloat

Jeremy Warner 12 May 2018

The former boss of Northern Rock, Adam Applegarth, pinpointed the start of the first credit crunch as 9 August 2007.

It was the "day the world changed," he said.

Guardian 1 December 2011

The European Central Bank and the US Federal Reserve injected $90bn (£45bn) into jittery financial markets that day,

but it was still not enough to stop banks being frozen out of the markets they relied on for funding.

Barely a year after Applegarth signalled the start of the credit crunch, Lehman Brothers collapsed, unleashing mayhem in the market and a series of bank bailouts.

Full text

The ECB "will continue to monitor the situation while euro-area financial markets in general are going back to normal functioning,''

Mr Trichet said in a statement on Tuesday. 14/8 2007

See also nejtillemu.com/spricker.htm#crisistart

”Sverige är på väg mot en bostadskrasch”

Myndigheter och politiker har ungefär ett år på sig att agera innan de tvingas ta hand om en finanskris.

Göran Collert, Sverker Lerheden och Roland Petersson SvD 28 maj 2018

The high-yield bond market. That’s the polite name for “junk” bonds

issued by companies that can’t earn an investment-grade rating even from our famously lenient bond rating agencies.

John Mauldin 25 May 2018

First, many of these companies are so marginal that even a mild economic downturn could render them unable to make bond payments.

The second layer is that bondholders will want to sell those bonds, but the liquidity they presume probably won’t be there.

Almost half of investment-grade companies are rated BBB, just one step above junk, up from just one-third in 2009.

When the economy breaks, some of those companies will run into trouble. Some of those will get downgraded, which will force many funds to sell them, thereby intensifying the liquidity storm I’ve described.

Full text

Top of page

Goldman conclude that, when it comes to market risk factors, "liquidity is the new leverage"

in a world in which HFTs are the marginal price setters

Zerohedge 22 May 2018

High-frequency traders (HFTs)

Fast forward to today when Goldman strategist Charles Himmelberg is back with a new report, which picks up where his last piece left off, defining "Liquidity as the New Leverage", and asking - rhetorically - "Will Machines Amplify the Next Downturn?"

The answer, of course, is "yes" as we have warned non-stop for almost 10 years now, but it is always gratifying to hear some non-tinfoil hat-wearing Goldmanite, i.e. FDIC-insured recipient of taxpayer bailouts, confirm it

Tin foil hat

Full text

Wall Street

Argentina peso boosted as central bank auction deemed a success

The central bank agreed to pay 40 per cent interest rates on the notes

FT 15 May 2018

Today’s high-yield bond market - I think the crisis will begin there

The problem will be massive illiquidity.

John Mauldin 11 May 2018

Trading can and will dry up in a heartbeat at the very time people want to sell.

William White, former chief economist for the Bank of International Settlements and now chairman for the OECD economic committee. This paragraph jumped out at me:

… the trigger for a crisis could be anything if the system as a whole is unstable.

Moreover, the size of the trigger event need not bear any relation to the systemic outcome.

The lesson is that policymakers should be focused less on identifying potential triggers than on identifying signs of potential instability.

Full text

Top of page

In an old-style economic cycle, recessions triggered bear markets.

Lower asset prices aren’t the result of a recession. They cause the recession.

That’s because access to credit drives consumer spending and business investment.

John Mauldin 11 May 2018

In an old-style economic cycle, recessions triggered bear markets. Economic contraction slowed consumer spending, corporate earnings fell, and stock prices dropped.

That’s not how it works when the credit cycle is in control.

Lower asset prices aren’t the result of a recession. They cause the recession. That’s because access to credit drives consumer spending and business investment. Take it away and they decline. Recession follows.

If some of this sounds like the Hyman Minsky financial instability hypothesis I’ve described before, you’re exactly right. Minsky said exuberant firms take on too much debt, which paralyzes them, and then bad things start happening. I think we’re approaching that point.

The last “Minsky Moment” came from subprime mortgages and associated derivatives.

Those are getting problematic again, but I think today’s bigger risk is the sheer amount of corporate debt, especially high-yield bonds that will be very hard to liquidate in a crisis.

Minsky

The old fashioned sequence of causation, of course, was that stock markets don't crash until they are triggered by warning signs, or the actual onset, of recession.

Unlike during your grandfather's industrial era heyday circa 1960, the main street economy today is not the master and consumer of finance.

David Stockman 11 May 2018

If financial crashes trigger recessions, of course, you can't see them coming by reading the mainstreet entrails or looking for telltale recession warnings in the infamous "incoming data" from the Washington statistical mills.

The story is essentially the same in the run-up to the financial crisis and Great Recession. Even after the subprime fissures broke out in the spring and summer of 2007 and the stock market stalled at its new peak of 1550 in October and November, the incoming data appeared solid, as shown below.

Indeed, the stock peddlers declared that it was an age of goldilocks, and that because there was no risk of recession, the market had only one way to go--up. Thus, the street consensus estimate at year-end 2007 was for a 17% gain on the S&P 500 to 1825 by December 2008.

Alas, the index actually came in 40% lower at 1050, and was on its way to at blow-out bottom of 670 by March 2009.

Full text

Top of page

What could possibly go wrong?

Bond investors do not care if Argentina is solvent in 100 years

When Argentina issued its so-called “century bond” in June last year, many held it up as the peak of bull market insanity.

After all, what sane individual lends money for 100 years to a serial-defaulter?

Robert Smith FT Alphaville 11 May 2018

After all, as Jay Powell, the Fed chair, observed this week:

“Some investors and institutions may not be well positioned for a rise in interest rates.”

Gillian Tett FT 10 May 2018

Låt er inte luras – vi ser en kollapsad bomarknad

Patricia Hedelius SvD 23 april 2018

Håller vi på att återuppleva 2007?

Om utlänningar börjar bli nervösa över hur det står till i landet så kan bankerna få problem eftersom två tredjedelar av de pengar de lånar upp är utländsk valuta.

Birgitta Forsberg, SvD Näringsliv 30 april 2018

"How Wrong I Was": Albert Edwards Says "My Reputation For Calling Stocks Is In Tatters"

zerohedge 25 April 2018

Twin reports by the IMF sketch a chain-reaction of dangerous consequences for world finance.

The policy – if you can call it that – puts the US on an untenable debt trajectory.

It smacks of Latin American caudillo populism, a Peronist contagion that threatens to destroy the moral foundations of the Great Republic.

Ambrose Evans-Pritchard Telegraph 18 April 2018

The IMF estimates in its Fiscal Monitor out today that the US budget deficit will spike to 5.3pc of GDP this year

There are two elephants in the room. One is well-understood: the world is leveraged to the hilt

The second elephant is global dollar debt.

Much of this lending is carried out by European and Japanese banks using short-term instruments

such as commercial paper and interbank deposits, leaving them “structurally vulnerable to liquidity risks”.

Full text

---

IMF Sounds The Alarm On Global Debt, Warns "United States Stands Out"

zerohedge 18 April 2018

... the world’s public and private sectors are more in debt now than at the peak of the 2008 financial crisis, when global debt/GDP peaked at 213%.

When looking at the big picture, needless to say it's all about the US, China and Japan: these three countries alone accounted for half of the $164tr total in global public and private sector debt.

And speaking again of China, its debt surged from $1.7 trillion in 2001 to $25.5 trillion in 2016

Full text

Banks

Top of page

The striking similarities between mortgage-backed securities

and the 17th century collateralized treasury obligations

Moshe A. Milevsky MarkeWatch 5 April 2018

If markets can forgive and forget after only a decade of history, then I guess there is little hope they will learn from lessons that took place centuries ago.

On January 2nd 1672 King Charles II defaulted on the collateralized treasury obligations

The amount of debt on which England defaulted was approximately one year’s worth of government tax revenues

Moshe A. Milevsky is a Professor of Finance at the Schulich School of Business in Toronto, and author of the recently published book “The Day the King Defaulted: Financial Lessons from the Stop of the Exchequer in 1672”

Full text

Other crashes

Economics failed us before the global crisis

Analysis of macroeconomic theory suggests substantial ignorance of how economies work

Martin Wolf FT 20 March 2018

Top of page

Hyman Minsky And Asset Price Inflation Versus Consumer Price Inflation

Creditwritedownsdcom 19 March 2018

There ain’t no recession.

Larry Kudlow, National Review, 5 December 2007

Yes, 2007

Full text

---

In fact, when Larry Kudlow waxed eloquently in a piece in the National Review about the awesome economy the George Bush Administration had produced in December 2007, he was just delivering the Wall Street consensus forecast for the coming yea

David Stockman 16 march 2018

The takeover of Bear Stearns by JPMorgan Chase

sealed exactly a decade ago in the crucible of the 2008 financial crisis,

the knockdown price of $2 a share was a shock to Wall Street.

FT 15 March 2018

Full text

Top of page

The Fed can't legally save the world financial system in another 'Lehman' crisis

Ambrose Evans-Pritchard 14 February 2018

Neither central bankers nor Wall Street ever see these new style recessions coming because, in fact,

they can't be detected from even an astute reading of the macro-economic tea-leaves.

David Stockman 9 March 2018

Why Is No One Listening to Jeremy Grantham?

In normal times it’s reasonable to believe clients are concerned about how well a manager can handle a downturn.

“But in a bubble, forget it,” he says.

“Clients care much, much more about underperforming all their friends on the golf course.”

Institutional Investor 28 Fabruary 2018

Top of page

A valuable lesson from the Great Recession is that credit-supply expansions play a key role in subsequent recessions.

When lenders make credit more available or more affordable, households respond by taking on debt, which drives up aggregate demand

– that is, until the music stops.

Amir Sufi, Atif Mian, Project Syndicate 5 March 2018

Amir Sufi, Professor of Economics and Public Policy at the University of Chicago Booth School of Business, is the co-author of House of Debt.

Atif Mian is Professor of Economics, Public Policy, and Finance at Princeton University, Director of the Julis-Rabinowitz Center for Public Policy and Finance at the Woodrow Wilson School, and co-author of House of Debt.

Full text

House prices

House of Debt

American consumers have relied on appreciation of equity holdings and home values

to support over-extended lifestyles.

Stephen S. Roach 26 February 2018

Top of page

Here is a recipe for disaster. Eurozone reformers act as if the crisis never happened

Wolfgang Münchau, FT 18 February 2018

You start off by taking the two most toxic financial instruments of the past 20 years, and then merge them.

The first is the collateralised debt obligation, the complex instrument at the heart of the US subprime crisis a decade ago.

Next, you take a much more innocent-looking instrument: a sovereign bond from a eurozone country

Wolfgang Münchau, FT 18 February 2018

Read more here

Vincent Deluard of INTL FCStone

I believe that 2018 will be the mirror opposite of 1999.

A triple squeeze will drain global excess savings: the U.S. will become the world’s largest oil producer,

Germany will abandon its policy of budget surpluses, and India’s economic growth will outstrip China’s.

The three gluts arose together, and together they will vanish.

Who will supply the world’s capital after the retirement of these massive hoarders?

John Authers, FT 7 February 2018

Top of page

2017 the U.S. trade gap leaped to a nine-year high of $566 billion.

The last time the U.S. ran a surplus was in 1975.

MarketWatch 6 February 2018

Is the 9-Year Long Dead Cat Bounce Finally Ending?

Charles Hugh Smith, 6 February 2018

I hate to admit this, but I think I have found a good historical parallel for what is happening in the markets.

And it is with spring and summer of 2007, on the eve of the credit crisis.

John Authers, FT 6 February 2018

During the first 20-years of the Greenspan-incepted era of Bubble Finance, household leverage ratios exploded.

Whereas wage and salary incomes rose by $4.2 trillion or 2.9X, household liabilities soared by nearly $12 trillion or 5.2X.

David Stockman 5 February 2018

The next global economic downturn – probably in 2019 – will be traumatic for everybody,

given that we have already used up our monetary and fiscal powder, and exhausted popular consent for globalisation.

Ambrose Evans-Pritchard 31 January 2018

Top of page

Fed was focused on unemployment and inflation during the 1990s and early 2000s,

they failed to do anything about the massive buildup of debt. This laid the groundwork for the financial crisis.

John Mauldin Lacy Hunt January 2018

In 2016, total corporate debt increased by $717 billion, yet investment in plant and equipment fell by $21 billion.

Where did the money go? Buybacks and dividend payouts

John Mauldin Lacy Hunt January 2018

What macroeconomists actually do

Problems can be traced back to two intellectual revolutions

Martin Sandbu 16 January 2018

Rethinking macroeconomics

The deepest effort to date to account for how economics failed us in the crisis

Martin Sandbu 15 January 2018

U.S. Trade Deficit Balloons to Widest in Almost Six Years

Bloomberg 5 January 2018

Top of page

Central banks have created the illusion of calm. It won't last.

Satyajit Das, Bloomberg 3 januari 2018

The current stable instability has its origins in the errors of 2008 and 2009, when leaders avoided painful but necessary actions, such as writing off unrecoverable debt and allowing corporate and bank failures.

The underlying problems of over-indebtedness, a financialized economy and expectations of unrealistic increases in living standards were allowed to persist, creating a weak and vulnerable recovery.

By boosting asset prices, policy makers aimed to buttress elevated debt levels and, via the wealth effect, increase confidence, consumption and investment. But rising values of financial instruments representing claims on productive assets don't create real purchasing power unless converted into cash or real enterprises producing earnings.

Any gain for a seller of such assets is contingent on somebody else buying and holding the security, frequently with borrowed money. The economy itself does not benefit from the transfer.

Higher asset values are neither permanent nor sustainable.

Full text

Satyajit Das is a former banker and author of Traders, Guns and Money: Knowns and Unknowns in the Dazzling World of Derivatives, and

Extreme Money: The Masters of the Universe and the Cult of Risk

Do eerie parallels presage new crisis?

Falling oil, rising dollar and US rate rise fears also present in 1997-98

Satyajit Das, FT February 23, 2015

The very toxin that sparked the crisis is relied on to reboot economies in the Americas and Europe.

Pascal Blanque and Amin Rajan, FT 4 January 2017

How to explain the paradox of low market volatility, record highs on the world’s stock markets and reduced levels of investor anxiety despite rising political risk?

Axel Weber, former head of the Bundesbank, now chairman of UBS, FT 1 January 2018

Crisis and Response: An FDIC History, 2008–2013

FDIC December 2017

Full text

The Coming Financial Crisis

Bank deposits fell strictly into two classes, depending on the preference of the depositor and the terms offered by banks:

time deposits, and demand deposits.

Doug Casey 27 December 2017

Top of page

Heretics welcome! Economics needs a new Reformation

Steve Keen was one of the economists who knew there was big trouble brewing in the years leading up to the financial crisis of a decade ago but whose warnings were ignored.

Larry Elliott, the Guardian's economics editor, 17 December 2017

The Keynesian Fed economists who were dismissive of Reagan’s trickle-down theory

still don’t appear to see the irony in the fact that they applied trickle-down monetary policy

in the hope that by giving a boost to asset prices they would create wealth that would trickle down to the bottom 50% of the US population or to Main Street.

It didn’t.

John Mauldin 17 November 2017

“Shadow banking”

It's larger than the world economy. It poses risks to financial stability.

Bloomberg, 20 November 2017

Top of page

Olivier Blanchard and Lawrence H. Summers

Rethinking Macroeconomic Policy

“We’ve learned over the past 10 years that fiscal policy can have pretty powerful effects

in deep recessions when central banks have hit very low policy interest rates,”

Gemma Tetlow, FT 13 November 2017

Changes in broadly shared economic assumptions are far more likely to trigger a sell-off,

by prompting investors to reassess the likelihood of actually realizing projected cash flows.

Cristopher Smart, Project Syndicate, 8 November 2017

There might be a dawning awareness among investors that growth rates are slowing,

or that central banks have missed the emergence of inflation once again.

Or the change might come more suddenly, with, say, the discovery of large pockets of toxic loans that are unlikely to be repaid.

Full text

Top of page

Unfinished Business:

The Unexplored Causes of the Financial Crisis and the Lessons Yet to be Learned, by Tamim Bayoumi

Martin Wolf, 1 December 2017

Regulators, led by Alan Greenspan at the Fed, believed the efficient markets hypothesis, that bankers’ self-interest would avert excesses.

For Tamim Bayoumi this was the north Atlantic financial crisis.

Created jointly in the US and western Europe, it also had its worst effects in these areas.

Europe’s crisis dragged on because of flaws in the political structure of the eurozone;

but in essence it continued a crisis born of a bloated, perversely incentivised north Atlantic banking system.

Many call it the “Lehman crisis”, but Lehman Brothers did not fall until over a year after debt markets crashed,

or the “subprime crisis” (which implies that it was driven by lending to people with poor credit in the US).

It is mostly now known as the “GFC”, which stands for the great or global financial crisis.

Full text

About the book at Amazon

Martin Wolf

"I made a mistake in presuming that the self-interests of organisations, specifically banks and others, were such that they were best capable of protecting their own shareholders and their equity in the firms," said Greenspan.

The Guardian 24 October 2008

We’re in bubble territory again, but this time might be different

Martin Wolf, FT 10 November 2017

Favourable global economic prospects, particularly strong momentum in the euro area and in emerging markets led by China and India, continue to serve as a strong foundation for global financial stability.”

This statement opened the International Monetary Fund’s April 2007 Global Financial Stability Report.

Since this benign view was published on the eve of the most devastating financial crisis in nearly eight decades, it has to be viewed, in hindsight, as a spectacular misjudgment.

Martin Wolf, about IMF Global Financial Stability Report, FT 24 October 2017

FT Series Financial crisis anniversary

Economic theory discredited

Gordon Brown has described his failure to rally the nation round

the “necessary fiscal stimulus” following the financial crisis as

one of the biggest regrets of his time in office.

FT 30 October 2017

In a new book set to be published next week, the former Labour prime minister expressed dismay over his inability to convince the public that progressive policies “were the right and fairest way to respond” to the global recession.

“Taming globalisation and redirecting it to meet the interests of working people has been, and still is, the defining political challenge of our era.”

Full text

My Life, Our Times by Gordon Brown

Globalisation

Gordon Brown told a US conference he had not realised the "entanglements" of global institutions

BBC 11/4 2011

Top of page

IMF Global Financial Stability Report

With market and credit risk premiums at decade-low levels, asset valuations are vulnerable to a “decompression” of risk premiums — in blunter words, a crash.

We cannot tell people they must remain stuck in a deflationary economy because it is the only way to stop the financial system from exploding.

Martin Wolf, about IMF Global Financial Stability Report, FT 24 October 2017

Zhou Xiaochuan, the long-serving and respected governor of the People's Bank of China,

raised eyebrows last week when he cautioned that the country could have a "Minsky Moment" if "we are too optimistic when things go smoothly."

Mohamed A. El-Erian, Bloomberg 23 October 2017

There is one economist whose name is on everyone's lips today.

It is this man, the late Hyman Minsky

The phrase "Minsky Moment" coined by the former Pimco economist Paul McCulley

John Authers, FT 29 October 2017

Financial Crises

The Economist Essay

Black Monday, October 19 1987, the US stock market fell by more than 20 per cent.

October has always been the month of highest crash risk — in addition to 1987, try 1929, 1997 and 2008

The big question is: could it happen again?

John Authers, FT 17 October 2017

Lots of people were supposed to prevent the financial crisis.

But while a few warned about the dangers in real time, most policymakers, risk managers, and academics failed in their responsibility to protect the rest of us.

Matthew C Klein, FT 13 September 2017

These booms took the form of greater household borrowing, significantly faster inflation, and a big uptick in the size of the notoriously unproductive construction sector. Rather than encouraging worthwhile investments, easier lending standards only exacerbated the amplitude of the cycle:

After the fact, the common defence was that the crisis so complex and unusual that it would have been impossible to predict...

The aggressive form of this argument is that those who were worried during the go-go years of the 2000s were simply perpetual pessimists who had gotten lucky.

Full text

Economic theory discredited

How the dollar’s weakness is the rest of the world’s problem

Forex markets pose a threat to a synchronised recovery needed to validate stock prices

Mohamed El-Erian, FT 13 September 2017

One of the inescapable truths of the past 10 years is that

the central bank policies introduced to mitigate the crisis may be sowing the seeds of another one.

As in the run-up to 2007, ultra-low interest rates have been distorting the world’s finances.

Patrick Jenkins, FT’s financial editor, 31 August 2017

Full text

Själv brukar jag med en dåres envishet upprepa följande ord, första gången den 5 december 2009

Jag tycker det är skriande uppenbart att räntan världen över är för låg och att en större del av stimulanserna borde ske via finanspolitiken.

Rolf Englund

Top of page

Mr Draghi gave a brutally honest account of central bank failings before the Lehman crisis,

admitting that the orthodoxies of the day bore little relation to reality on the ground.

There was too much trust in the dogma of “rational expectations” and a chronic neglect of how capital markets really work.

Mario Draghi speaking at a forum of Nobel Prize economists at Lake Constance, Ambrose Evans-Pritchard, Telegraph 23 August 2017

Fannie Mae and Freddie Mac, government-sponsored enterprises which had historically guaranteed about half of all new mortgages,

were brought under a tightly-controlled federal “conservatorship” and propped up with $188bn of taxpayer funds.

FT 18 August 2017

Ten years ago on Tuesday the first ripples of what became the financial crisis hit the markets.

On the evening of Aug 8 2007, BNP Paribas, France’s largest bank, told clients that it was suspending three of its funds,

because of the “complete evaporation of liquidity”, which made it impossible to value its assets.

And yet, despite its bailout, many still believed it was a blip, with BNP Paribas calling its fund freeze a “technical issue”. *

It took more than a year and the dramatic collapse of Lehman Brothers to roughly shake the rest of the world awake to

the horrific realisation that the global financial system could implode.

Ashley Armstrong, Telegraph 7 August 2017

Full text

August 9 2007 was the day when BNP Paribas, the French bank, froze three investment funds.

Investors whose money was placed in suddenly toxic securities linked to US real estate,

were no longer permitted to cash out their investments

Martin Sandbu, FT 9 August 2017

The FT marks the anniversary witha chart-rich series on what the crisis did to the global economy

April 2006, when US house prices peaked, and an unprecedented — and unexpected — nationwide decline began.

Full text

Will the dam break in 2007?

Joseph Stiglitz, The Guardian 27/12 2006

Top of page

Why there was no New Deal after the Great Recession

Since the financial crisis there has been a lack of boldness in thought, as well as action

Martin Sandbu, FT 24 July 2017

Attractive outlines for the form of economic policy “regime change” they would like to see:

in Avent’s case, a central bank commitment to target stable growth in nominal national income (rather than stable prices);

in Kaletsky’s, a hope “that the ‘progressive’ economics of full employment and redistribution could be combined with the ‘conservative’ economics of free trade and labor-market liberalisation”.

Full text

Kaletsky, Anatole

Top of page

Fed's Yellen expects no new financial crisis in 'our lifetimes'

That’s an unusually bold statement for any Fed leader, much less the chair.

Patrick Watson at John Mauldin 3 July 2017

It sure would be nice if Yellen were right. We’d all go to our graves (hopefully not too soon) without ever having seen another financial crisis.

Not so fast, though. Let’s see exactly what Yellen meant, and what it means for your investment strategy.

"Would I say there will never, ever be another financial crisis?" Yellen said at a question-and-answer event in London.

"You know probably that would be going too far, but I do think we're much safer, and I hope that it will not be in our lifetimes and I don't believe it will be," she said.

This was a head-scratcher to me. While it wasn’t a prepared text, Yellen would still never say anything like this by accident.

Full text

Janet Yellen

Top of page

For investors scrambling to keep pace with a hawkish shift in the world’s biggest central banks,

the second half of 2017 just got a lot more interesting.

Bloomberg 29 June 2017

Populism and immigration

The financial crisis and consequent economic shocks not only had huge costs.

They also damaged confidence in — and so the legitimacy of — financial and policymaking elites.

These emperors turned out to be naked.

Martin Wolf FT 27 June 2017

Full text

Economic theory discredited

Top of page

The global economy is caught in a permanent trap of boom-bust financial cycles.

This deformed structure is becoming ever more corrosive and dangerous as debt ratios rise to vertiginous levels, BIS has warned.

Ambrose Evans-Pritchard, 25 June 2017

“Minsky moment,” the point at which excess debt sparks a financial crisis.

The late Hyman Minsky said that such moments arise naturally when a long period of stability and complacency eventually leads to the buildup of excess debt and overleveraging.

At some point the branch breaks, and gravity takes over. It can happen quickly, too.

John Mauldin, 17 June 2017

Can We See A Bubble If We're Inside The Bubble?

Charles Hugh Smith via zerohedge, 16 June 2017

Full-Time Jobs Tumble By 367,000, Biggest Drop In Three Years

Tyler Durden, zerohedge 2 June 2017

US consumers’ behaviour is altered by seismic events — Americans now save more and spend less

Rana Foroohar, FT 26 May 2017

The lack of trust among the general population in what the future will look like, and the ability of elites to manage it.

Economists such as Robert Shiller have speculated that decreased demand in the economy reflects “vague fears” about long-term employability

Full text

Secular Stagnation

Markets Don't Trust Banks, and They're Right

The financial crisis should have led to fundamental change. It hasn’t happened.

Mark Whitehouse, Bloomberg 30 maj 2017

Central banks response to the crisis almost a decade ago is still the key driver of markets

FT 26 May 2017

This summer marks a decade since the first stirrings of the global financial crisis. A lot of water has flowed since two hedge funds backed by Bear Stearns collapsed in July 2007 because of their exposure to US subprime mortgages.

The steady expansion of central bank balance sheets via quantitative easing is still keeping the now-familiar show of equities at record levels and negligible risk premiums firmly on the road.

Full text

ZIRP

Top of page

Ten years on: When the music stopped

How the 2007-08 crisis unfolded

The Economist 6 May 2017

In February 2007 Britain’s HSBC shocked markets by raising its bad-debt provisions to $10.5bn because of failing American subprime mortgages.

During that summer two hedge funds run by Bear Stearns, an investment bank, collapsed after losing money on soured subprime investments.

As banks started to worry about exposure to subprime lending and the piles of complicated derivatives connected to it,

credit markets began to seize up, causing BNP Paribas, a French bank, to suspend withdrawals from three funds in August.

In November 2007 the music stopped even for Mr Prince: he resigned.

That quarter Citi took subprime-related write-downs of $18.1bn.

Full text

Top of page

A decade after the crisis, how are the world’s banks doing?

For too many, leverage was the path first to profit and then to ruin.

The Economist 6 May 2017

Revised international rules, known as Basel 3 (still a work in progress),

have forced banks to bulk up, adding equity and convertible debt to their balance-sheets.

The idea is that a big bank should be able to absorb the worst conceivable blow

without taking down other institutions or needing to be rescued.

Full text

Top of page

Only one-third of American home values have recovered pre-recession peaks

MarketWatch 3 May 2017

Soaring Trump dollar risks global trade war and China currency crisis, warns Posen

Donald Trump will succeed in ramming through radical tax cuts and fiscal stimulus, causing US federal borrowing to balloon.

The Peterson Institute thinks the current account deficit could rise to 5pc of GDP.

Ambrose Evans-Pritchard, 11 April 2017

If something cannot go on forever, it will stop.”

This is “Stein’s law”, after its inventor Herbert Stein, chairman of the Council of Economic Advisers under Richard Nixon.

Rüdiger Dornbusch, a US-based German economist, added:

“The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.”

Martin Wolf, FT 11 april 2017

Staggeringly high UK house prices may only be corrected by a market crash,

according to economists from the University of Reading.

Bloomberg 11 April 2017

Top of page

The smart money is record ‘short’ in stocks, and the dumb money is record ‘long’

hedgers have racked up more short positions than at any other time in history

Simon Maierhofer, MarketWatch 6 April 2017

It feels like 2008 again

In 2017 total household debt will reach its previous peak of $12.68 trillion,

which it reached in the third quarter of 2008.

MarketWatch 3 April 2017

Full text

Top of page

Homeowners are pulling cash out again

Fast-rising home prices gave homeowners more equity than many expected,

and they are now tapping that equity at the fastest rate in eight years.

Diana Olick, CNBC 3 April 2017

The problem with cocos more broadly is that nobody knows if they work.

Lloyds Bank of the UK issued the first coco as part of a big capital restructuring in 2009.

Over $153bn of the securities have been issued since

FT 21 March 2017

Postmortem plans for banks under threat of exinction

If there was one big realisation to come out of the financial crisis

— alongside the fact that banks were riskier than believed —

it was this: policymakers did not know how to wind up a bank without causing chaos.

FT 6 March 2017

Today, there is worrying evidence on both sides of the Atlantic that the resolution idea could be in jeopardy before it has been fully implemented, let alone tested.

Full text

Lehman

Banks

Top of page

Banks globally have paid $321 billion in fines since 2008

for an abundance of regulatory failings from money laundering to market manipulation and terrorist financing,

according to data from Boston Consulting Group.

Bloomberg 2 March 2017

The global financial system is no safer today than it was in 2007.

If those who use overnight mortgage pools receive priority over other creditors, as is the case today...

Mark Roe, professor at Harvard Law School, Project Syndicate, 31 January 2017

Top of page

Explanations for the Financial Crisis

Barry Ritholtz, Bloomberg 18 January 2017

Discussions of causation frustrate those who seek to oversimplify the complex as they pursue a political agenda

(see Peter Wallison at the American Enterprise Institute).

Any theory that claims to explain the financial crisis should be able to answer these 10 questions

...

I’ll stop at 10. How did your model do in explaining these issues? If you can adequately answer these questions and have the data to back them up, you may be on to a successful model of the financial crisis.

Full text

Top of page

Moody’s in $864m settlement over subprime mortgage bonds

The settlement is smaller than the $1.375bn that rival rating agency S&P Global reached in February 2015

FT 14 January 2017

Full text

Top of page

The latest Economic Report of Obama’s Council of Economic Advisers

Mr Obama’s presidency began amid the worst financial crisis since the 1930s.

If we consider the disaster he inherited

and the determination of the Republicans in Congress to ensure he would fail,

his record is clearly successful. This does not mean it is perfect.

Martin Wolf, FT 10 January 2017

The latest Economic Report of the President analyses the Obama record.

It is also the brief for the defence. But Mr Obama’s Council of Economic Advisers does first-rate analysis.

This report is no exception to that rule.

As the report notes, perfectly correctly:

“It is easy to forget how close the US economy came to an outright depression during the crisis. Indeed, by a number of macroeconomic measures... the first year of the Great Recession ... saw larger declines than at the outset of the Great Depression in 1929-30.”

Full text

Top of page

Do Central Bankers Know A Bubble When They See One?

From its March 2000 peak to its October 2002 bottom the NASDAQ declined 80%.

In August 2002 Greenspan gave a speech at the Fed’s conference in Jackson Hole.

Ben Bernanke, gave a speech titled, “The Great Moderation.”

zerohedge 3 January 2017

Just over $6.6tn

Global debt sales reached a record in 2016

led by companies gorging on cheap borrowing costs

breaking the previous annual record set in 2006

FT 27 December 2016

Top of page

How policymakers plan to solve a long-term global debt crisis

Bill Gross, 6 December 2016

Full text

Top of page

The Bank of England’s chief economist has admitted his profession is in crisis

having failed to foresee the 2008 financial crash and having misjudged the impact of the Brexit vote.

So what can the dismal science do to regain the trust of the public and politicians?

Guardian 6 January 2017

Full text

Economic theory discredited

Top of page

The return of Keynesianism

Martin Sandbu's Free Lunch, FT 24 October 2016

A speech given by Federal Reserve chair Janet Yellen 10 days ago has received a lot of attention in the economic community

and deserves an even broader hearing.

Its modest focus — it is titled “Macroeconomic research after the crisis” — is deceptive.

Beyond useful research recommendations, Yellen’s words carry more profound implications,

including an admission of the extent to which central bankers are navigating in the dark,

and a return to much more aggressive policies for demand management than modern macroeconomic theory had until recently admitted.

Full text

By reducing the incomes of retirees and terrifying near-retirees,

the Fed successfully reduced economic activity.

John Mauldin 9 October 2016

Ray Dalio Warns A 1% Rise In Yields Would Lead To Trillions In Losses

zerohedge 8 October 2016

Globally, the stock market is about $69 trillion in size,

trading about $191 billion in shares per day.

The bond markets are well north of $140 trillion,

and trade about $700 billion in volume per day

zerohedge 4 October 2016

More than nine years after the start of the global financial crisis,

worries over the health of the financial system remain significant, especially in Europe.

Martin Wolf. FT 4 October 2016

This should not be surprising. But it should be disturbing.

Full text

Top of page

We are still groping for truth about the financial crisis

It has been eight years since Lehman Brothers went bankrupt and still it defines the calendar.

For anyone in the financial world, time is divided into Before Lehman, and After Lehman.

John Authers, FT 16 September 2016

And yet, even after eight years, the crisis’s lessons are controversial. Anger is as intense as ever.

And when it comes to making the financial system proof against another Lehman, every day seems to bring further proof that we do not know what we thought we knew.

Full text

Lehman Brothers

Basel

Senator Elizabeth Warren wants law enforcement officials to tell her

why none of the individuals referred to them by the Financial Crisis Inquiry Commission

for potential law-breaking related to the crisis were ever prosecuted.

MarketWatch 15 September 2016

On the eighth anniversary of the Lehman Brothers bankruptcy on Thursday, the Massachusetts Democrat asked the Inspector General of the Department of Justice and FBI Director James Comey

for an investigation into the lack of individual criminal prosecutions for potential law-breaking related to the 2008 financial crisis.

Full text

Top of page

All told, the primary effect of monetary policy since 2008 has been to transfer wealth

to those who already hold long-term assets — both real and financial — from those who now never will.

John Kay, Financial Times 9 September 2016

Echoes of 2008 as danger signs are ignored

Tett, FT 1 September 2016

In 2013 economists at the IMF rendered their verdict on these austerity programmes:

they had done far more economic damage than had been initially predicted, including by the fund itself.

What had the IMF got wrong when it made its earlier, more sanguine forecasts?

It had dramatically underestimated the fiscal multiplier.

The Economist print 13 August 2016

Highly Recommended

Since August 2007 the 471 financial companies that form Datastream’s financials equities sector

lost over one trillion euros in market value.

FT 8 August 2016

Full text

Banks

The 2007-08 episode clearly demonstrated that financial crises, particularly when they involve the banking sector,

can be enormously expensive both in terms of direct fiscal costs and associated costs for the real economy.

Over the period 2008-14 accumulated gross financial sector assistance by euro area governments amounted to 8% of euro area GDP,

of which, so far, around 3% has been recovered

Lecture by Vítor Constâncio, Vice-President of the ECB, 7 July 2016

Full text

Here We Go Again — August 2007 Redux

If this is beginning to sound like August 2007 that’s because it is.

David Stockman 5 July 2016

After reaching a peak of 1550 on July 18, 2007, the S&P 500 stumbled by about 9% during the August crisis, but the dip-buyers kept coming back in force on the one-off assurances of the sell-side “experts”. By October 9 the index was back up to the pre-crisis peak at 1565 and then drifted lower in sideways fashion until September 2008.

Upon the Lehman event the fractures exploded, and the hammer dropped on the stock market in violent fashion. During the next 160 days, the S&P 500 plunged by a further 50%.

Altogether, more than $10 trillion of market cap was ionized.

The claim that you can capitalize the stock market at an unusually high PE multiple owing to ultra-low interest rates,

therefore, implies that deep negative real rates are a permanent condition, and that governments will be able to destroy savers until the end of time.

The truth of the matter is that interest rates have nowhere to go in the longer-run except up

Full text

Frozen withdrawals in 2007 and 2015

Three UK real estate funds halt selling

"Redemptions have now reached a point where M&G believes it can best protect the interests of the funds' shareholders

by seeking a temporary suspension in trading. This will allow the fund manager time to raise cash levels

in a controlled manner, ensuring that any asset disposals are achieved at reasonable values," M&G said in a statement.

CNBC 5 July 2016

Top of page

The Brave New Uncertainty of Mervyn King

Paul Krugman, The New York Review of Books, Issue 14 July 2016

Although The End of Alchemy is more a book of theory inspired by recent economic crises than an account of those crises,

it does, inevitably, tell a story about what went wrong.

First, as many people have noted, the run-up to the global financial crisis that struck in 2007–2008 was a two-decade era of unusual economic calm, at least in wealthy countries,

commonly referred to as the Great Moderation — although for some reason King calls it the Great Stability instead.

This long era of stability may have encouraged complacency, both in the private sector and among policymakers,

so that evidence of an increasingly fragile financial system was ignored.

Traditionally, banks had a substantial “cushion” of equity — there was enough difference between their loans and their debts that they could absorb significant losses on loans without going bankrupt.

On the eve of the crisis, however, much of the financial system had enormous leverage — the ratio of debt to equity was 25 to 1 or more — leaving it extremely vulnerable to panic.

And the panic came.

Full text

Skuldfrågan/ Who is responsible?

In spite of the “biggest monetary policy stimulus in the history of the world” the results have been anaemic.

“Central banks have thrown everything at their economies, and yet the results have been disappointing,” he notes.

“Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced.”

The End of Alchemy: Money, Banking and the Future of the Global Economy by Mervyn King – review

John Kampfner, The Guardian 14 March 2016

Full text

Marian Radetzki, unemployment and Stall Speed

David Stockman's Conspiracy Theory

Along with Goldman’s plenipotentiary at the US Treasury, Hank Paulson,

Bernanke stampeded the entirety of Washington into tossing out the window the whole rule book of

sound money, fiscal rectitude and free market discipline.

In fact, there was no extraordinary crisis.

The Lehman failure essentially triggered a self-contained leverage and liquidity bust in the canyons of Wall Street

13 April 2016

2016: The End Of The Global Debt Super Cycle

ZeroHedge, 1 April 2016

The day after the 1987 crash (Oct. 20, 1987) Alan Greenspan, Chairman of the Fed, announced to the world that

The Fed stood ready to provide whatever liquidity was needed by the banking system

to prevent the crash from turning into a systemic financial crisis.

That was the day the Fed “put” was born.

Fed Funds Rate drop from 6.5% to 1% from 2000 to 2003.

This in effect morphed the tech stock bubble into a housing bubble.

The world economy is in no position to absorb another big deflationary shock.

The possibility of another big deflationary shock from China over the next several years is real.

Martin Wolf, FT 29 March 2016

Why I am reading Stockman and Varoufakis

Englund blog 26 March 2016

Money, Banking and the Future of the Global Economy, by Mervyn King.

Review by John Plender, FT 3 March 2016

Fed is now 87 months into its grand experiment with the lunacy of zero interest rates.

David Stockman 16 March 2016

Atlanta Fed's gauge of "sticky-price" inflation in the US

soared to a post-Lehman peak of 3 pc

Ambrose 2016-03-16

The subprime crisis, the euro crisis, the China slowdown, the oil bust.

But surely these events are connected.

Justin Fox, Bloomberg View 10 March 2016

I’m confident we would see improvement on all fronts

if we got GDP growth back up to 4% for a few years.

John Mauldin, March 7, 2016

Top of page

News

Baltikum Swedbank SEB och Bolånen

Andreas Cervenka, SvD 3 mars 2016

7 big risks are now plaguing the U.S. and global economies

Nouriel Roubini, MarketWatch Mar 2, 2016

It is widely agreed that a series of collapsing housing-market bubbles triggered the global financial crisis of 2008-2009, along with the severe recession that followed.

Now, five years later, signs of frothiness, if not outright bubbles, are reappearing in housing markets

Nouriel Roubini, Project Syndicate, 19 november 2013

The next global financial crisis could start with U.S. stocks.

Satyajit Das, MarketWatch 2 March 2016

Now, despite evidence that the world economy is near to another recession, a similar survey shows that

not one of the 40 leading economists believes there will be a US downturn this year.

Ruchir Sharma, FT February 29, 2016

All told, however, a sharp decline in the S&P 500 has signalled a recession nearly 60 per cent of the time.

By contrast, the consensus view of economists has an accuracy rate of zero per cent.

The writer is head of emerging markets and global macro at Morgan Stanley Investment Management

Full text

Economic theory discredited

Top of page

News

Eight years after triggering a crisis that nearly brought down the global financial system, the United States remains plagued by confusion about what reforms are needed to prevent it from happening again.

What Americans are sure about is that they are angry with the financial sector.

This is reflected in the success of recent Hollywood movies such as The Big Short

Jeffrey Frankel, a professor at Harvard University, Project Syndicate 24 Febr 2016

At the center of Sanders’s campaign is a proposal to break up the big Wall Street banks into little pieces, thereby ensuring that no bank is so big that its failure would endanger the rest of the financial system.

The first bank that was declared “too big to fail” was Continental Illinois, which received a bailout in 1984 from President Ronald Reagan.

Attacking banks is emotionally satisfying. But it won’t prevent financial crises.

In fact, the financial industry’s biggest problems lie elsewhere:

hedge funds, investment banks, and other non-bank financial institutions that face less regulatory oversight and restrictions (such as on capital standards and leverage) than commercial banks.

Recall that Lehman Brothers was not a commercial bank, and AIG was an insurance company.

the Dodd-Frank Wall Street Reform and Consumer Protection Act

Dodd-Frank was far from complete. Making matters worse, many in Congress have spent the last six years chipping away at it, such as by exempting auto dealers from the CFPB and restricting the budgets of the regulatory agencies.

Full text

Too Big to Fail

Basel

World economy stands on the cusp of another crash,

warns Lord Mervyn King. Telegraph 26 Febr 2016

Click

It’s different this time.

The actions of governments and central banks should make a difference during a crisis - this time, they may not

Ben Wright, Telegraph 18 Feb 2016

Investors are often derided for having memories like goldfish. But the scar of the 2008 financial crisis is still raw.

Many were blindsided by the credit crunch and vowed not to be caught out again

If fiscal and monetary policy is supposed to be the last defence against market worries,

then it’s not ideal when the market’s biggest worries are inspired by fiscal and monetary policy.

Full text

Top of page

News

Faced with the most severe economic downturn since the Great Depression, the U.S. Federal Reserve did the only thing it could: flood the financial system with liquidity.

The move to so-called easy money arguably saved the world from a worse fate and radically changed the economic backdrop as well as the landscape for financial markets.

Bloomberg via englundmacro.blogspot.se/2016/02/these-are-things-that-correlate

Top of page

News

China's own version of 'The Big Short'

Rolf Englund blog 9 Febr 2016

The Bank of Canada admits easy money can inflate debt bubbles

FT Alphaville 8 Febr 2016 via Rolf Englund blog

The lunatic valuation of the FANGs (Facebook, Amazon, Netflix and Google)

100X+ PE multiples are always and everywhere a deformed artifact of central bank driven Bubble Finance

David Stockman 30 January 2016

Full text

Top of page

AMZN and its three other FANG amigos had accounted for a $530 billion gain in market cap

while the other 496 stocks in the S&P 500 had declined by even larger amount.

That is, the apparently flat S&P 500 index of 2015 was hiding an incipient bear—–owing to a market narrowing action like none before.

Compared to the Fabulous FANGs (Facebook, Amazon, Netflix and Google)

David Stockman, January 13, 2016

News

The $29 Trillion Corporate Debt Hangover That Could Spark a Recession

The seven-year-old global growth model based on cheap credit from central banks is running out of steam

Bloomberg 28 January 2016

In the past 30 years, there have been only three 20 per cent falls in the S&P that did not overlap with a recession.

All involved financial accidents.

So the argument that the damage should not be bad if we avoid a recession is reasonable. But why exactly did markets rebound?

In all three cases, the Federal Reserve eased monetary policy, when it had intended to tighten.

In 1987, there were three rate cuts, not reversed for almost a year. Rates ended that cycle two percentage points higher than they were on the eve of Black Monday.

LTCM also triggered three rate cuts.

In 2011, with rates already at zero, the Fed responded with “Operation Twist” to try to push down bond yields.

Full text

RBS has advised clients to brace for a “cataclysmic year” and a global deflationary crisis,

warning that major stock markets could fall by a fifth and oil may plummet to $16 a barrel.

Ambrose Evans-Pritchard, 11 Jan 2016

“Fangs” — Facebook, Amazon, Netflix and Google

As with the first Shanghai Surprise, the stark reaction to this week’s Chinese events reveals deep lack of confidence in the health of the western corporate sector.

Even if the situation now stabilises — as it did for several months back in 2007 —

the message of concern, in both west and east, is clear.

John Authers, FT 8 January 2016

One of the (many) fascinating things about this latest global financial crisis is that there’s no single catalyst.

Unlike 2008 when the carnage could be traced back to US subprime housing, or 2000 when tech stocks crashed and pulled down everything else,

this time around a whole bunch of seemingly-unrelated things are unraveling all at once.

zerohedge 7 January 2016

Submitted by John Rubino via DollarCollapse.com

Interest rates, for instance, were high by current standards at the beginning of past crises, which gave central banks plenty of leeway to comfort the afflicted with big rate cut announcements.

Today rates are near zero in most places and negative in many.

Full text

Top of page

News

A Year of Sovereign Defaults?

Carmen Reinhart, Project Syndicate 31 December 2015

Like so many other features of the global economy, debt accumulation and default tends to occur in cycles. Since 1800, the global economy has endured several such cycles, with the share of independent countries undergoing restructuring during any given year oscillating between zero and 50%

The most recent default cycle includes the emerging-market debt crises of the 1980s and 1990s. Most countries resolved their external-debt problems by the mid-1990s, but a substantial share of countries in the lowest-income group remain in chronic arrears with their official creditors.

Read more at https://www.project-syndicate.org/commentary/sovereign-default-wave-emerging-markets-by-carmen-reinhart-2015-12#z8IKDElycECkDZ8Q.99

Welcome, then, to what Carmen Reinhart, senior fellow at the Peterson Institute for International Economics in Washington,

and Harvard’s Kenneth Rogoff call “the second great contraction” (the Great Depression of the 1930s being the first).

Top of page

|